Ongoing regulatory uncertainty has limited the general adoption and growth of crypto in US. With new regulations, this could come to an end.

Author: Yves Longchamp

The crypto markets have grown considerably and numerous regulatory authorities are seeing increased systemic risks connected to the sector.

The Metaverse is the next step in the digitalization of our economies and carries significant challenges with regards to consumer protection.

A forecast of regulatory developments and a unified approach to crypto regulation in the US for the year 2022.

The Securities and Exchange Commission of the United States (SEC) has rejected eleven bitcoin spot ETFs. A criticism of the SEC’s approach.

Layer-2 solutions try to solve the problem of absurd transaction costs on decentralised blockchains such as Ethereum. An overview.

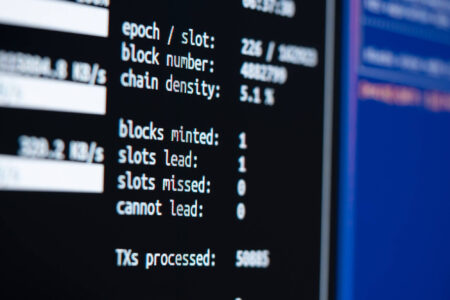

To ideally serve users with diverse use-cases, blockchains need to overcome the scalability problems of decentralised networks.

Global regulatory agencies are cooperating to integrate crypto assets and DeFi applications into the current financial system.

DeFi is a new financial paradigm that generates significant benefits. As of September 2021, DeFi transactions were funded by no less than USD 88.7 billion. The risks associated with DeFi are also significant and amplified by its unregulated environment. Since 2017, the evolution of the crypto industry has shown that a regulatory approach that can provide certainty to the private sector, support innovation, and mitigate money laundering and investors’ risk can boost cryptocurrencies adoption. The same holds true for decentralised finance (DeFi). The critical question is how to regulate DeFi. In this context, the current debate in the US suggests…

Since the cryptoasset market peaked in May, all major cryptoassets have taken a hit, and prices have remained under pressure. Measured in US dollar, the most indices dropped by double digits in June, more than Bitcoin (-5.3%), illustrating that altcoins have been impacted more heavily. However, last month’s performance differential should be taken with a pinch of salt. Indeed, most crypto indices’ year-to-date performance is more than 100%, while price of bitcoin has increased by about 21%, showing the massive outperformance of altcoins so far this year. The success of altcoins mirrors the rise of DeFi applications that have boomed…

The largest decentralised asset management protocol on the Ethereum blockchain is currently Yearn Finance. It was a pioneer in this space and has grown to one of the largest projects in Decentralised Finance (DeFi). A thorough analysis of Yearn Finance and its token “YFI”. Yearn Finance is a decentralised finance (DeFi) protocol that pioneered asset management for passively earning yield on stable and risky assets. One can think of it as an automated asset manager allocating depositors’ funds into the best yield generating strategies for the highest returns. What started as a simple yield generating product called iEarn by developer…

Globally, the regulatory landscape for crypto financial services is fragmented, but developing and improving. Market participants investing in crypto assets or operating related processes may face considerable regulatory uncertainty, depending on their chosen jurisdiction. Our own records show that over 100 jurisdictions and at least 15 supranational bodies have taken formal steps to regulate crypto financial products and processes over the last few years. None of the supranational bodies have banned or prohibited it, and the large majority of countries have embraced the asset class by increasing regulatory certainty for market participants and promoting innovation in a risk-controlled way. Crypto…

Two authoritative market intelligence reports on the illicit use of cryptocurrencies, released in February 2021, evidence a marked decrease in the phenomena during 2020 – compared to 2019 – but also new worrying trends in the areas of ransomware and Decentralised Finance (DeFi). The most recent market intelligence on illicit use of cryptocurrencies made available during February 2021 by Chainalysis and CipherTrace are summarised as follows. Marked decrease in the illicit use of cryptocurrencies The year 2020 recorded a transactional value of $10bn associated with illicit on-chain activities. This number represents 0.34% of the total value of cryptocurrencies transactions. One…

Centralised Exchanges have played a pivotal role in the crypto asset ecosystem, acting as fiat ramps, custodians, exchange, market makers and VCs. Algorithmic smart contract based Decentralised Exchanges (DEXes) offer a non-custodial alternative and have turned into serious competition. Bitcoin started in 2010 as the first crypto asset, and the only way to acquire it initially was through mining or transacting with a miner. Mt. Gox, launched in July 2010, soon became the leading exchange to buy and sell bitcoins for US dollars. Enthusiasts did not have to mine or barter with miners to acquire bitcoin anymore. As the crypto…

Many look at Bitcoin (BTC) as a very volatile asset, unattractive for traditional investors looking to diversify their portfolio. Yet digital assets seem to drastically improve the Sharpe ratio, a measure frequently used to quantify the performance of a portfolio in contrast to risk. In the first few days of 2021, bitcoin (BTC) price reached a new all-time high of about $42,000, fell back by $10,000 to increase again to $38,000 at the time of writing. This episode depicts what bitcoin is to many investors: an attractive but volatile asset. With this backdrop, is there any benefit to add bitcoin,…

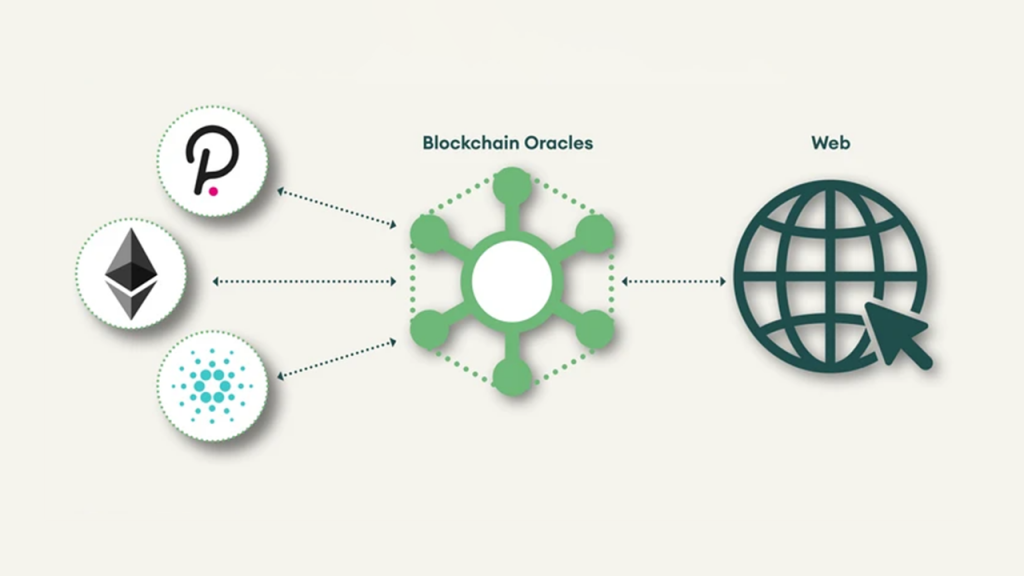

We discuss how blockchains’ inherent inability to connect to the real world limits their use and how oracles provide the solution by acting as middleware to their connection to the world. “The oracle problem” will be a central part of the analysis as well some of the leading projects. We find that oracles are pervasive in their use across decentralised applications and find use throughout all key themes and implementations of blockchain technology such as decentralised finance (DeFi), interoperability and supply chain. We also cover key oracle projects that are enabling the growing ecosystem of decentralised applications today. Blockchains are…