A summarizing review of what has been happening at the crypto markets of the past week. A look at trending sectors, liquidity, volatility, spreads and more. The weekly report in cooperation with market data provider Kaiko.

The last 7 days in cryptocurrency markets:

- Price Movements: Play-to-earn tokens have underperformed following the hack on Ronin network.

- Trade Volume: Weekly trade volume on centralized exchanges dropped to its lowest level since June 2021.

- Order Book Liquidity: Despite falling spot volumes, average price slippage remains steady.

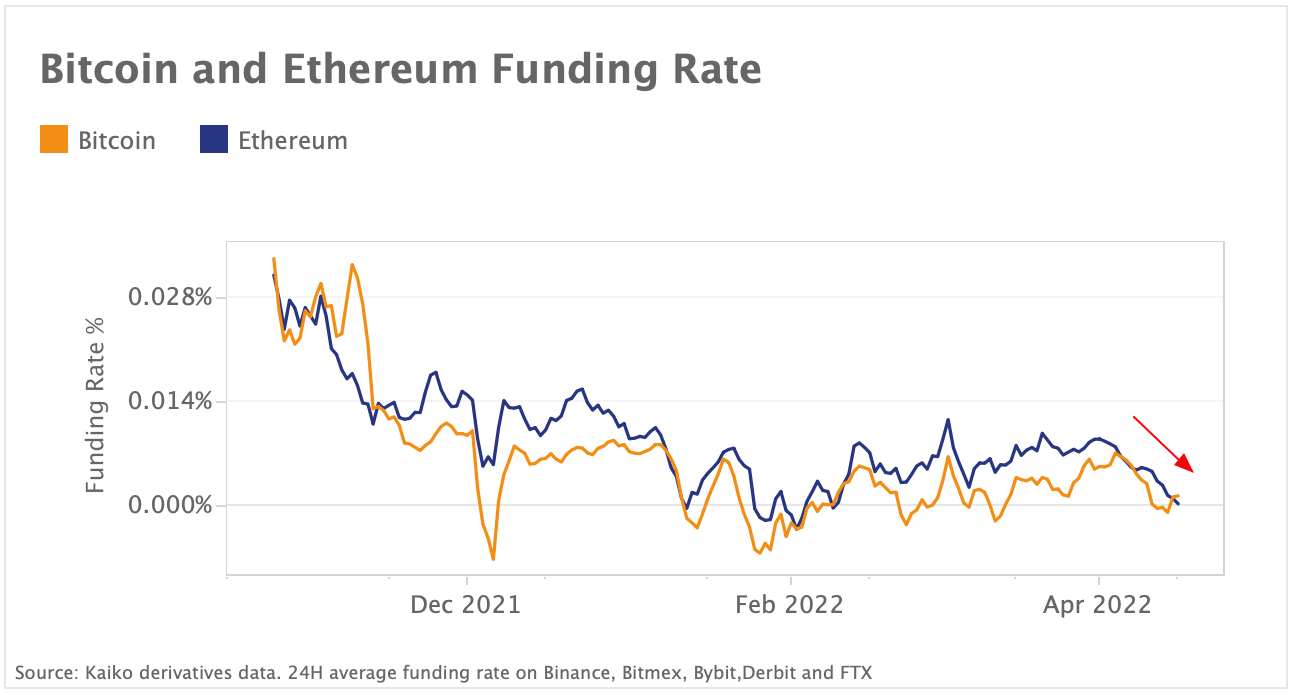

- Derivatives: Perpetual futures funding rates remain firmly neutral for both BTC and ETH.

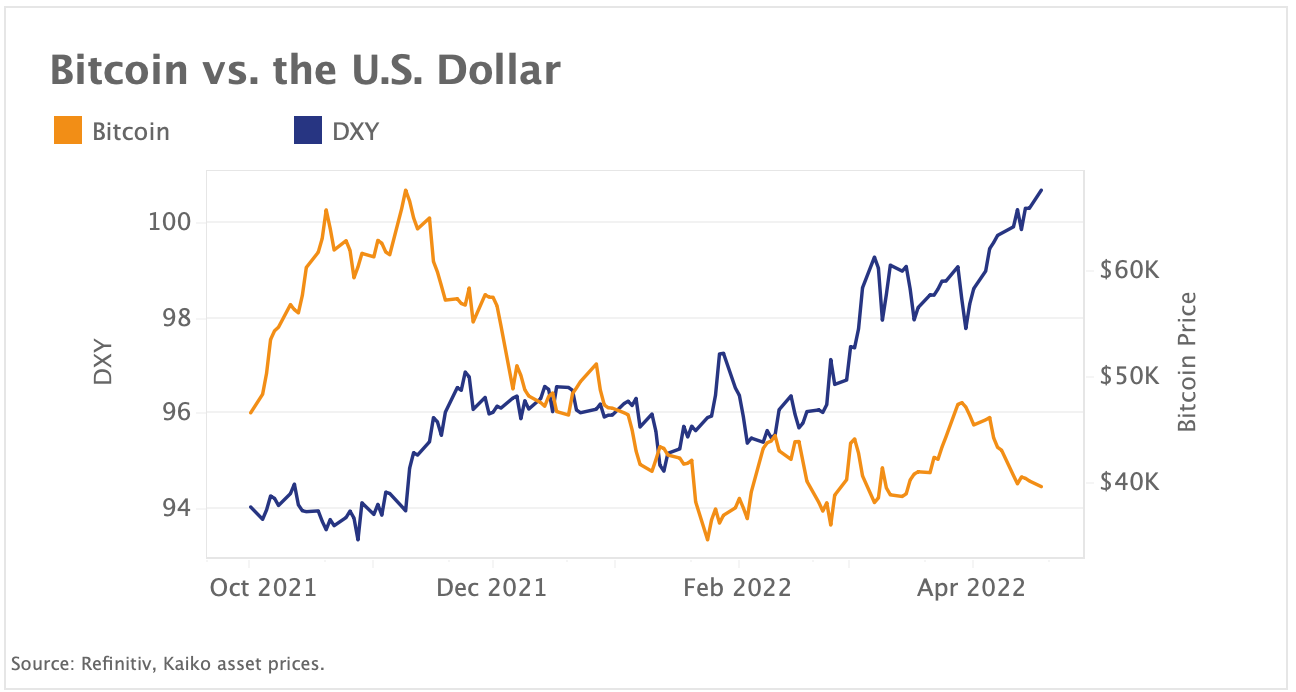

- Macro Trends: Bitcoin's inverse correlation with the U.S. Dollar index returned as the index broke 100.

High inflation print spooks financial markets

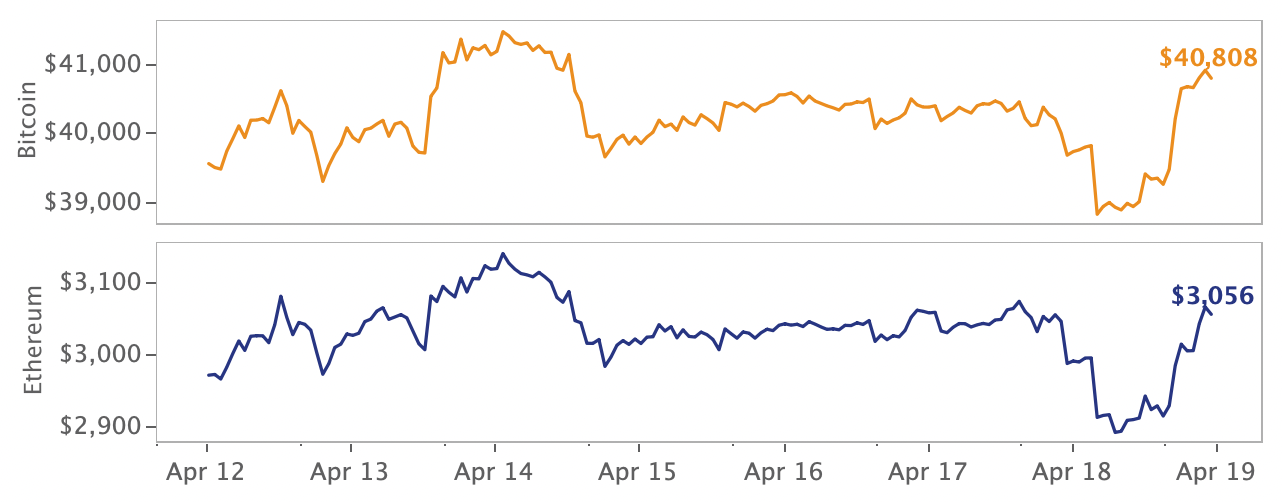

Bitcoin and Ethereum closed Sunday night in the red, moving in line with equities markets following another hot inflation print, although markets have since bounced with both assets up +4% over the past day. Despite the previous month’s lackluster returns, VC investment in crypto companies continues to pour in. Last week, stablecoin issuer Circle closed a $400m round and metaverse startup Animoca Brands raised $350m.

At the ecosystem level, Ethereum successfully completed a “shadow fork” test ahead of the blockchain’s move to proof of stake (although the merge will likely be delayed) while Terra and Avalanche swapped $200mn of tokens to “strategically align ecosystem incentives.” In the DeFi space, an exploiter used a flash loan to drain $180mn from the stablecoin project Beanstalk, leading to a loss of its $1 USD peg. Finally, the U.S. Department of the Treasury tied the Ronin/Axie hack to the North Korean hacking operation Lazarus Group.

DeFi liquidity experiment goes wrong

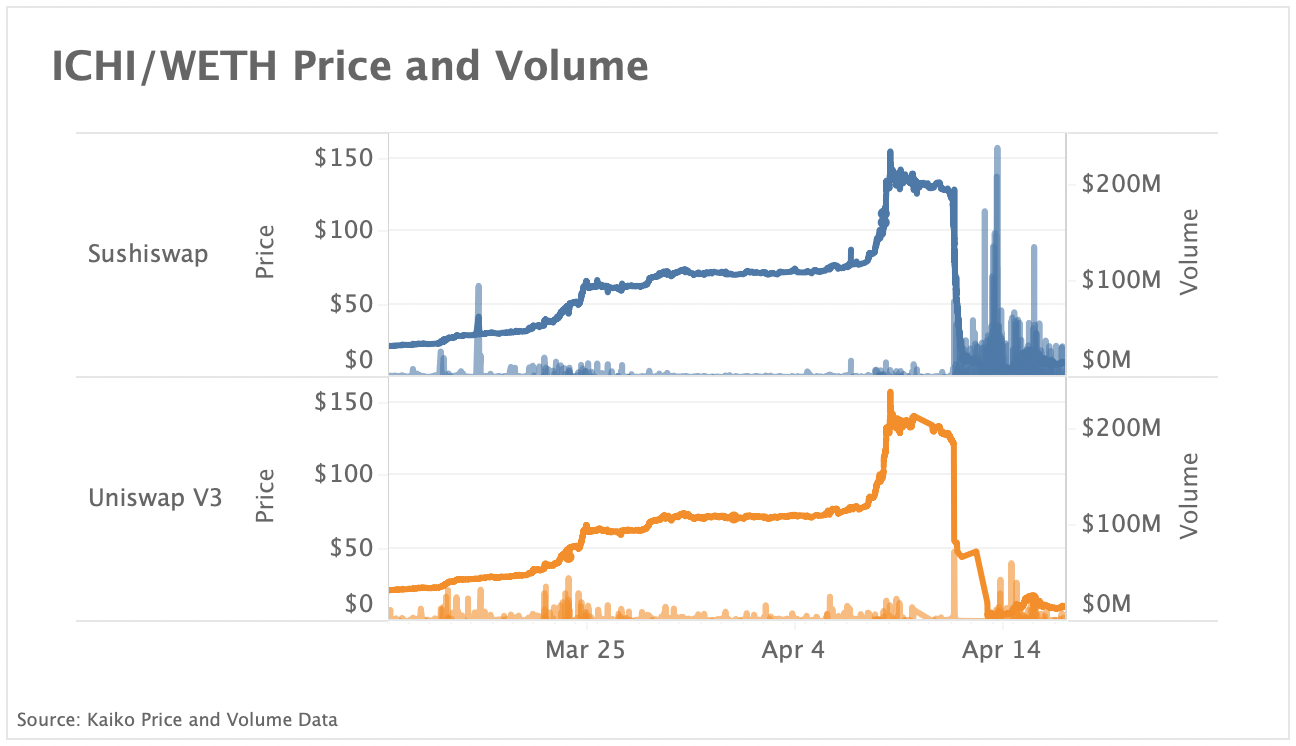

In the news last week was a previously under-the-radar DeFi protocol called ICHI, which offered users the ability to deposit tokens into “Angel Vaults”. Angel Vaults use Uniswap V3’s unique mechanism in which users can choose the prices at which they would like to provide liquidity to “establish a wall of liquidity directly under the price of a project’s token,” essentially creating a large buy wall. ICHI’s Angel Vaults were designed, in theory, to protect the token against market dips and initially contributed to a rapid price appreciation of the ICHI token (charted).

Yet, large sell volume on ICHI/WETH pairs - $1.39mn on Uniswap V3 and $2.4mn on Sushiswap, all in a single minute - pushed through the buy wall and crashed the price. Interestingly, because the vast majority of the pair’s liquidity on Uniswap V3 - which uses concentrated liquidity, unlike Sushiswap - was located close to the price, once price dropped out of this range there was virtually no remaining liquidity and thus very little volume.

It remains to be seen whether other DeFi protocols will immitate ICHI’s Angel Vaults mechanism to prop up the price, or whether Uniswap will take action to prevent this in the future. As of this writing, Uniswap has not made any statements about ICHI, though it has removed some of the protocol’s associated tokens from its frontend. The case highlights the difficulties in protecting investors on unregulated decentralized exchanges.

Play-to-Earn tokens underperform

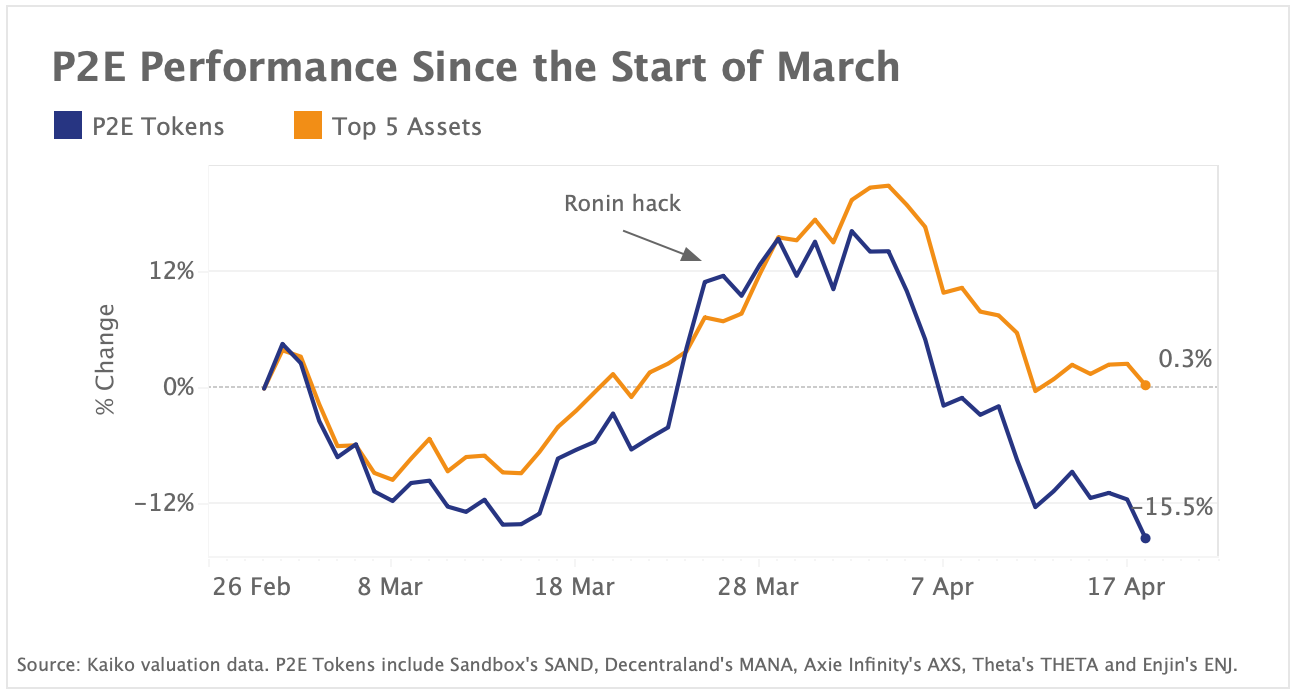

Play-to-earn (P2E) tokens have continued to struggle in the wake of the $620mn exploit of Ronin, the Ethereum sidechain hosting the popular Axie Infinity game. Sky Mavis, the creator of Ronin/Axie, has since announced that balance sheet funds and a $150mn funding round led by Binance would be used to ensure that all users affected by the Ronin hack will be reimbursed. However, the hack was a major blow to the P2E gaming space, and tokens affiliated with P2E projects have suffered. We chart an equally weighted portfolio of the top P2E tokens (AXS, ENJ, MANA, SAND), and can observe this sector is underperforming the top 5 crypto assets since March 1st. Overall, the top P2E assets are down about 70% off their November 2021 highs.

Trade volume falls to lowest level since June 2021

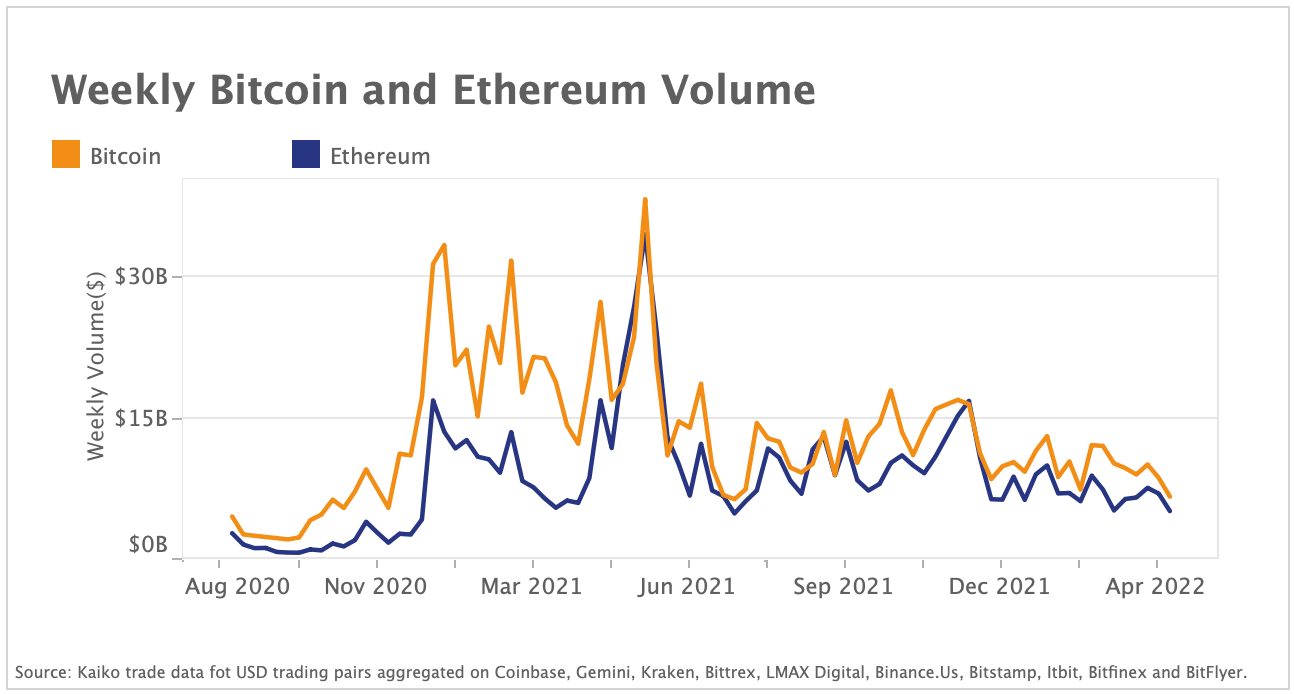

Bitcoin and Ethereum weekly trade volume on major centralized exchanges fell to its lowest level since the crypto bear market in the summer of 2021. Above we chart the average weekly trade volume for U.S. Dollar pairs aggregated across ten exchanges. Both Bitcoin and Ethereum trade volumes have declined significantly since December, as investors de-risked their portfolios amid growing macro uncertainty. The trend accelerated in early April with BTC and ETH weekly trade volume down by over 30% to $7B and $5B respectively, relative to the end of March.

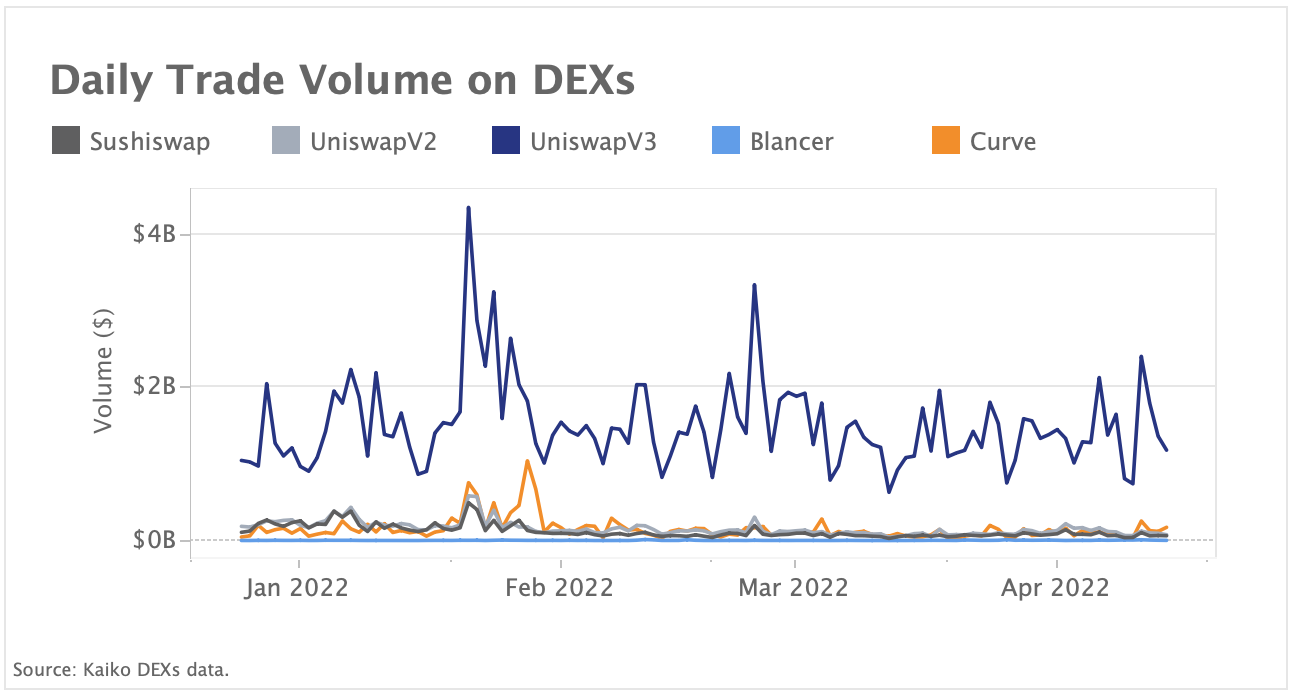

Uniswap V3 continues to dominate DEX volume

Uniswap V3, launched in May 2021, has dominated decentralized exchange (DEX) volume on the Ethereum network in 2022. The only day where another DEX's volume was comparable happened in late January on Curve. Uniswap V3’s innovations, particularly concentrated liquidity (allowing users to choose a price range at which they would like to provide liquidity) have proved wildly successful, and today the exchange accounts for the vast majority of DEX volume. However, the decentralized exchange has been a recent target of regulatory scrutiny and is now facing a class action lawsuit from a trader alleging that the exchange’s lack of identity checks encourages fraud. Overall, DEX volume has remained relatively lackluster throughout Q1 and increased regulatory attention could have a dampening effect on the DeFi ecosystem.

Funding rates are firmly neutral

Perpetual futures markets also point to muted bullish demand. The funding rates averaged across five derivatives exchanges – Binance, Bitmex, Bybit, Derbit and FTX - have continued their decline from late 2021. The funding rate is the mechanism that pegs the perpetual future contract price to the price of the underlying asset. Positive funding rates suggest that perpetual swaps prices are higher than the index price as more traders are entering long positions. Open interest and trade volumes declined in April which suggests capital outflows and low demand.

Bitcoin's inverse correlation with U.S. Dollar returns

While the inverse correlation between Bitcoin and the U.S. Dollar has mostly dissipated over the past year, the trend recently reemerged in early 2022. Above, we chart the U.S. Dollar index (DXY), measuring the performance of the greenback against a basket of foreign currencies, alongside Bitcoin’s price. The DXY has been rising steadily, gaining 4.7% YTD as the war in Ukraine boosted demand for safe havens, while Bitcoin's returns have been mostly bearish.

The growing hawkish divergence between the U.S. Fed and other major central banks also provided support for the greenback, which hit its highest level against the Japanese Yen (JPY) in 20 years. The Euro (EUR) lost 5% of its value against the USD since the start of the year on a deteriorated growth outlook coupled with a relatively dovish European Central Bank. For context, the Russian Ruble (RUB) is down 5.7% YTD.

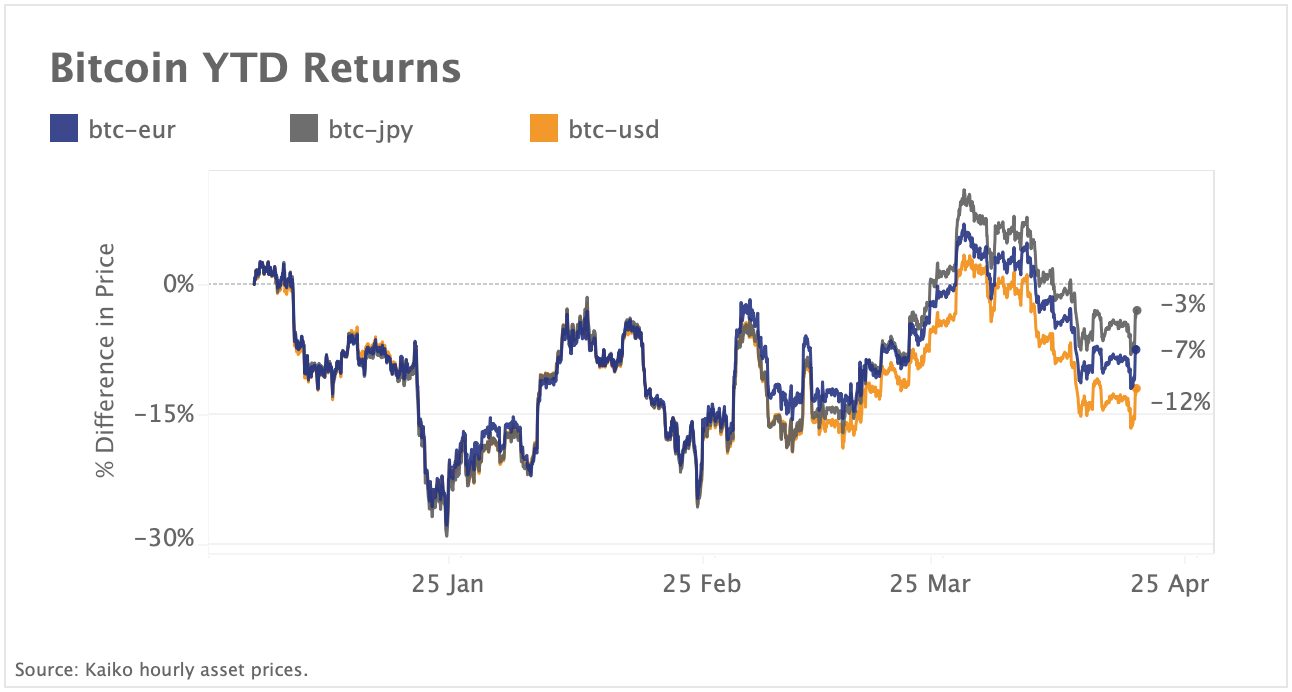

Foreign exchange volatility has increasingly spilled into crypto markets, exacerbating market inefficiencies and creating arbitrage opportunities. Examining YTD change in Bitcoin prices expressed in JPY and EUR and USD, we see that the divergence has risen markedly since March. BTC-Fiat pairs traded mostly in line with one another until late February, when market dislocations emerged.

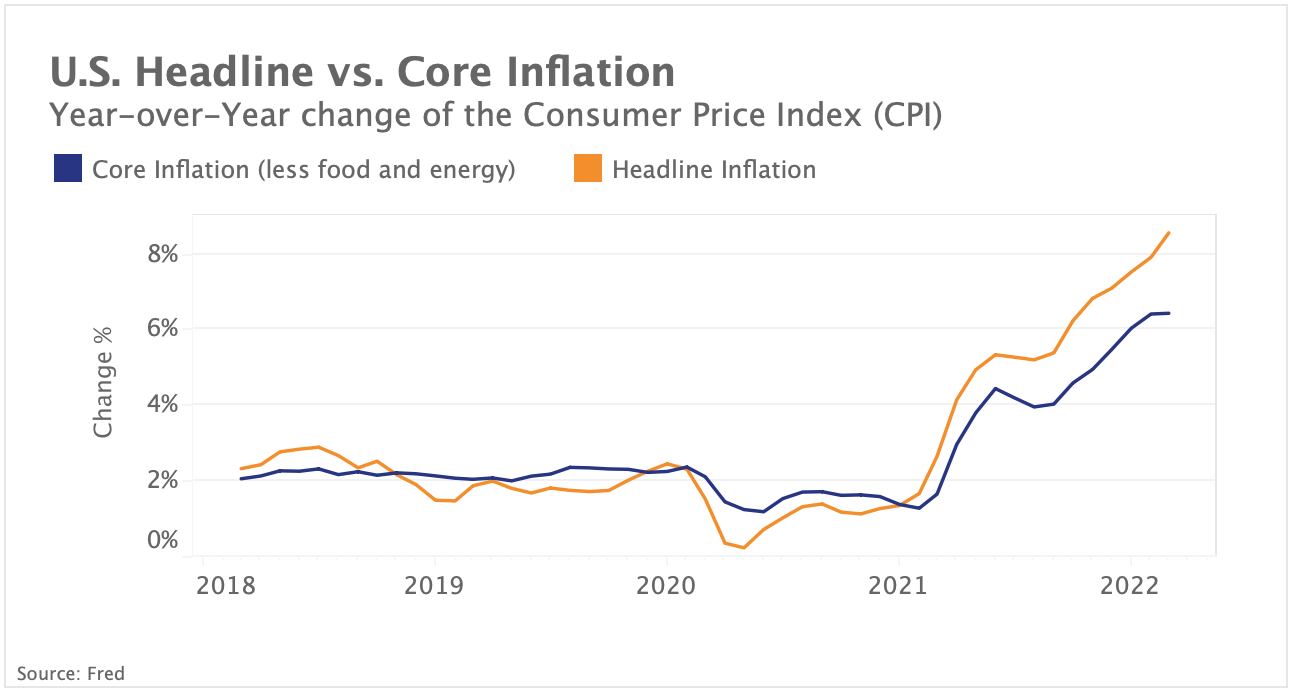

Hot U.S. inflation print spurs volatility

U.S. consumer price inflation rose by 8.5% last month, hitting a new multi-decade high. The reading injected volatility into the market, with risk assets trading sideways throughout the week. The core inflation figure (which excludes volatile food and energy costs) was smaller than expected, boosting hopes that inflation might be peaking. The chart above shows a growing divergence between headline and core inflation since the start of the year.

The tech-focused Nasdaq 100 spiked by 2% immediately following the release, before losing most of its gains, dragged down by a wobbly start of the earning season and renewed monetary tightening jitters. Bitcoin continued moving in tandem with tech stocks. Its 30-day rolling correlation with the Nasdaq 100 rose to .63, its highest level since September 2020.