A summarizing review of what has been happening at the crypto markets of the past week. A look at trending sectors, liquidity, volatility, spreads and more. The weekly report in cooperation with market data provider Kaiko.

The last 7 days in cryptocurrency markets:

- Price Movements: The stETH discount worsened after a whale withdrew $100m ETH from Curve.

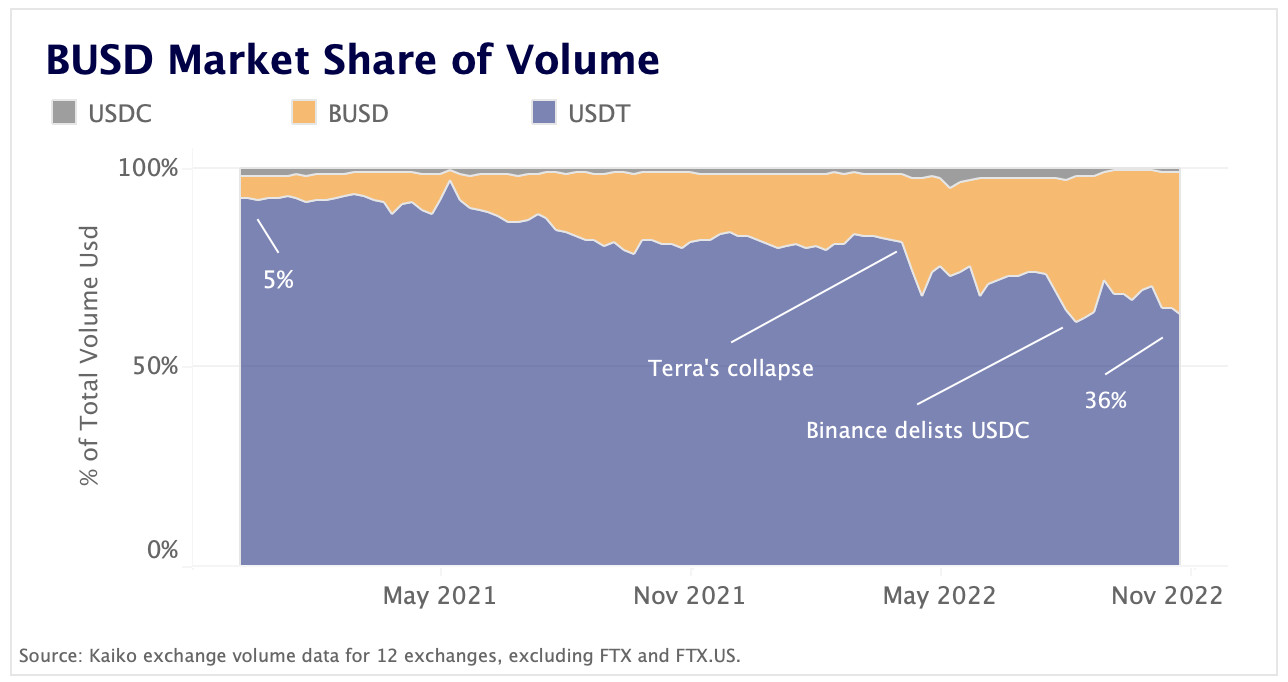

- Market Liquidity: BUSD's market share of volume on centralized exchanges is approaching all time highs.

- Derivatives: The ratio of futures to spot volume has experienced a 5x drop, meaning fewer derivatives are being traded relative to spot.

- Macro Trends: The price of bonds issued by crypto companies has plummeted alongside share prices as investors price in contagion risk.

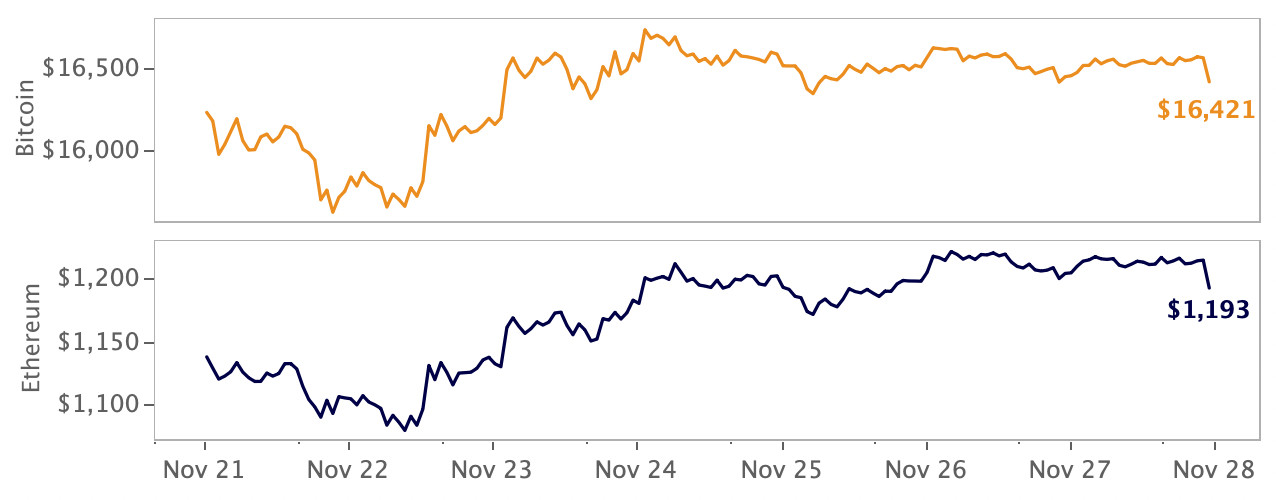

Markets trade flat as industry awaits Genesis outcome

Markets were flat over Thanksgiving with both Bitcoin (BTC) and Ethereum (ETH) trading steadily at two-year lows. The industry is anticipating an update on the Genesis situation following reports that a bankruptcy could be imminent should the lender fail to secure funding. Meanwhile, Binance announced the launch of a $1 billion industry recovery fund, Metamask revealed it collects IP addresses, and funds stolen by the FTX hacker are on the move.

Whale trader dumps $100m staked ether

Lido staked ether (stETH) is trading at a larger discount to ETH after a whale withdrew 84k ETH, roughly $100m, from Curve's stETH pool on Thursday. Following the removal, stETH made up more than 72% of the pool, however that allocation has since improved slightly and now sits at 66%. A perfectly balanced pool would contain 50% ETH and 50% stETH. Coinbase and Binance’s versions of staked ETH, cbETH and bETH respectively, continue to trade at a steady discount with little signs of improvement.

Stakers were left concerned last week after rumours emerged that the Ethereum Foundation would push back its timeline for enabling ETH withdrawals via the Shanghai upgrade. A deadline has yet to be set for the upgrade, which was initially promised to be rolled out 6-12 months after the Merge.

BUSD market share approaches new all time high

The market share of volume for Binance's BUSD is approaching new all time highs. BUSD is a USD-backed stablecoin developed by Binance in partnership with Paxos.

The stablecoin's market share has been growing steadily over the past two years, rising from 5% in early 2021 to 36% as of last week. The increase has been particularly dramatic since the collapse of Terra in May. While Tether’s USDT remains the dominant stablecoin on CEXs, its market share has fallen from over 92% to 64%. USDC's market share on CEXs has decreased to just 0.9%, though it is mostly traded on DEXs, with its trade volumes on Uniswap v3 nearly five times higher than on CEXs.

BUSD's usage surged after Binance removed fees for BTC trading pairs in July and delisted all USDC pairs in September. While USDT and USDC's market caps have declined over the past few months, BUSD’s market cap increased to an all-time high of $23bn mid-November before retreating slightly last week.

Illiquid altcoins are targets for DeFi manipulation

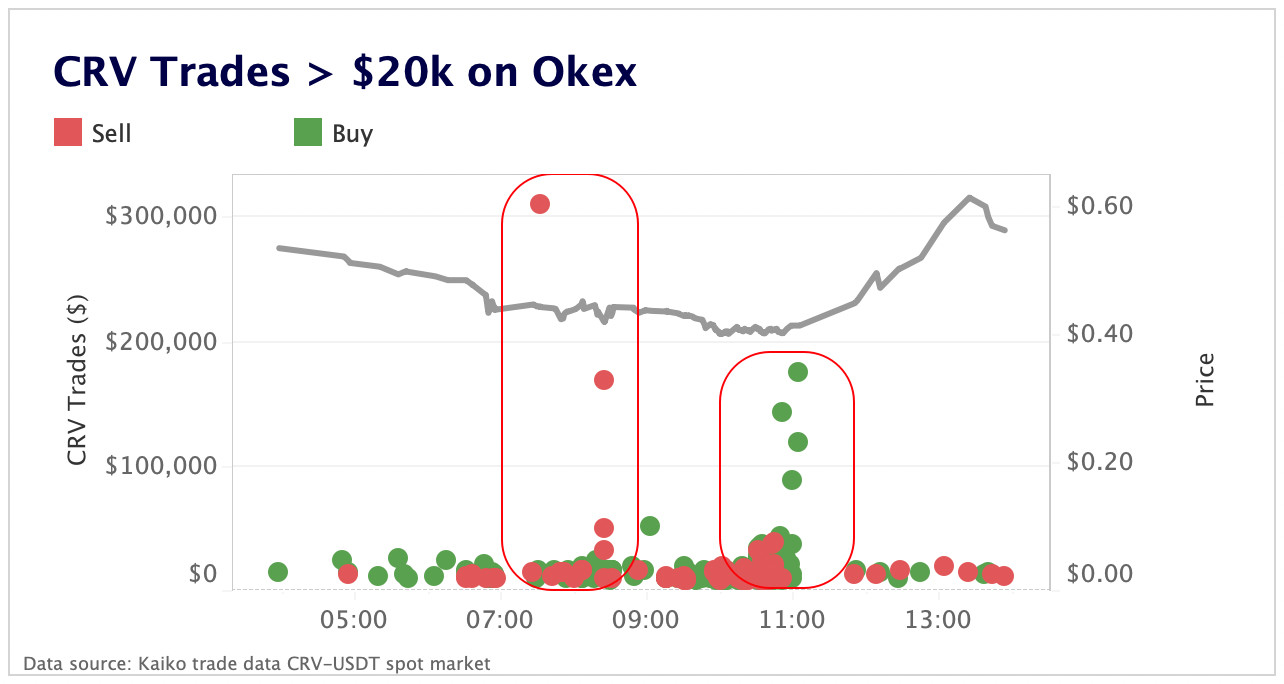

Illiquid altcoins are a growing target of manipulation on DeFi protocols. Last week, CRV, the governance and rewards token for the decentralized exchange Curve, suffered a manipulation attempt by a trader hoping to benefit from liquidations on the lending protocol Aave. The trader sought to short CRV while dumping $40m worth of CRV that had been taken out as a loan.

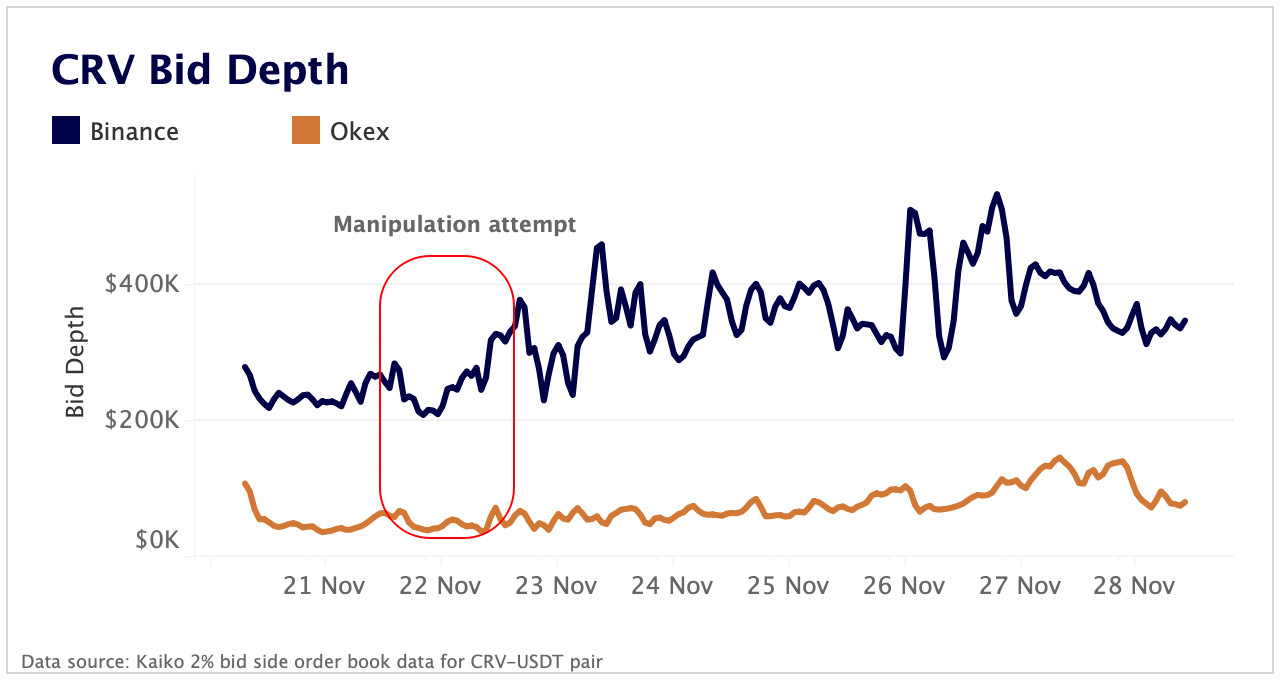

CRV is relatively illiquid on centralized exchanges. After taking loans from Aave, the trader transferred large chunks of CRV to OKX to start selling. OKX has the equivalent of just $40k on the bid side of CRV-USDT order books, compared with around $300k on Binance, making the exchange a prime target.

On November 22, we observed a wave of large market sell orders on OKX as the trader attempted to push down CRV's price to a level that would trigger liquidations on Aave, leaving the protocol with bad debt.

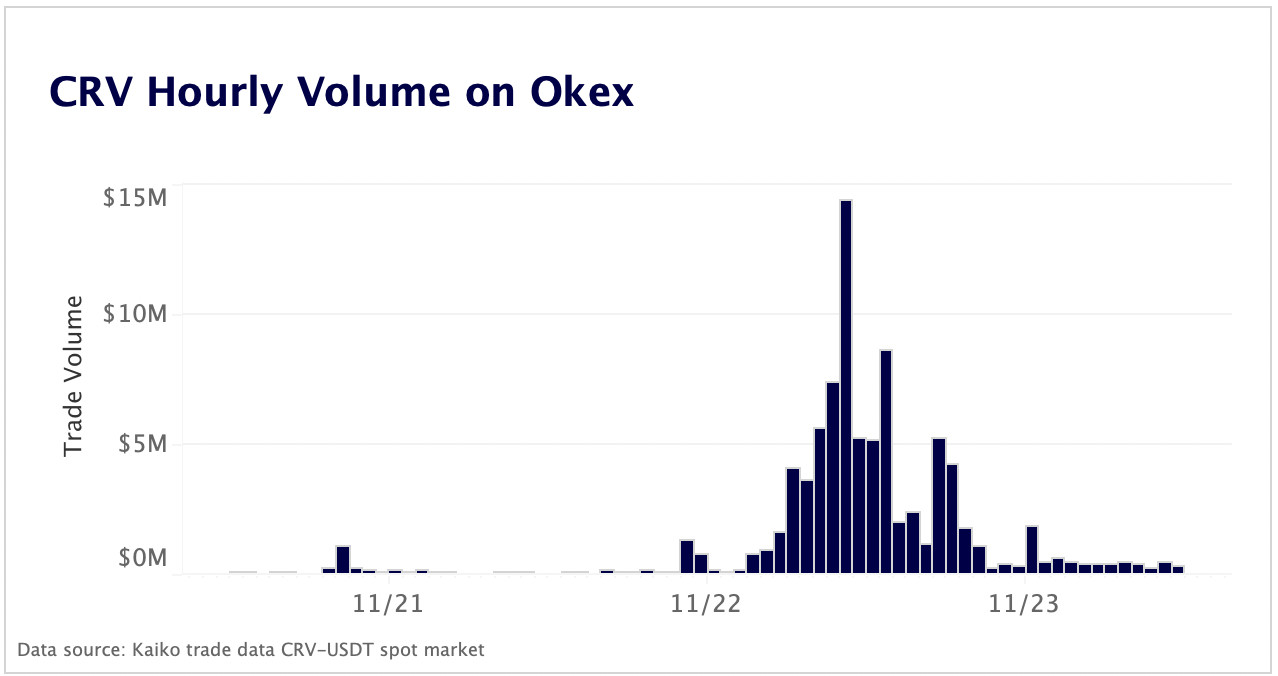

Throughout the day, CRV hourly volume on OKX hit all time highs, at one point surging above $15mn, up from an average of under $100k.

Coincidentally, Curve released the whitepaper for their upcoming stablecoin on the same day, which contributed to a burst of buying pressure for CRV, which thwarted the manipulation attempt by squeezing out the trader's short position. The trader ended up being liquidated on Aave, but this still caused the protocol to be left with $1.6mn in bad debt (not the worst case scenario, but still bad).

Ultimately, this event highlights the ease by which traders can manipulate illiquid tokens on centralized exchanges whose price feeds are used in DeFi protocols to determine liquidation levels. Yesterday, Aave halted lending pools for 17 assets including CRV, which were deemed illiquid and at risk of a similar type of attack.

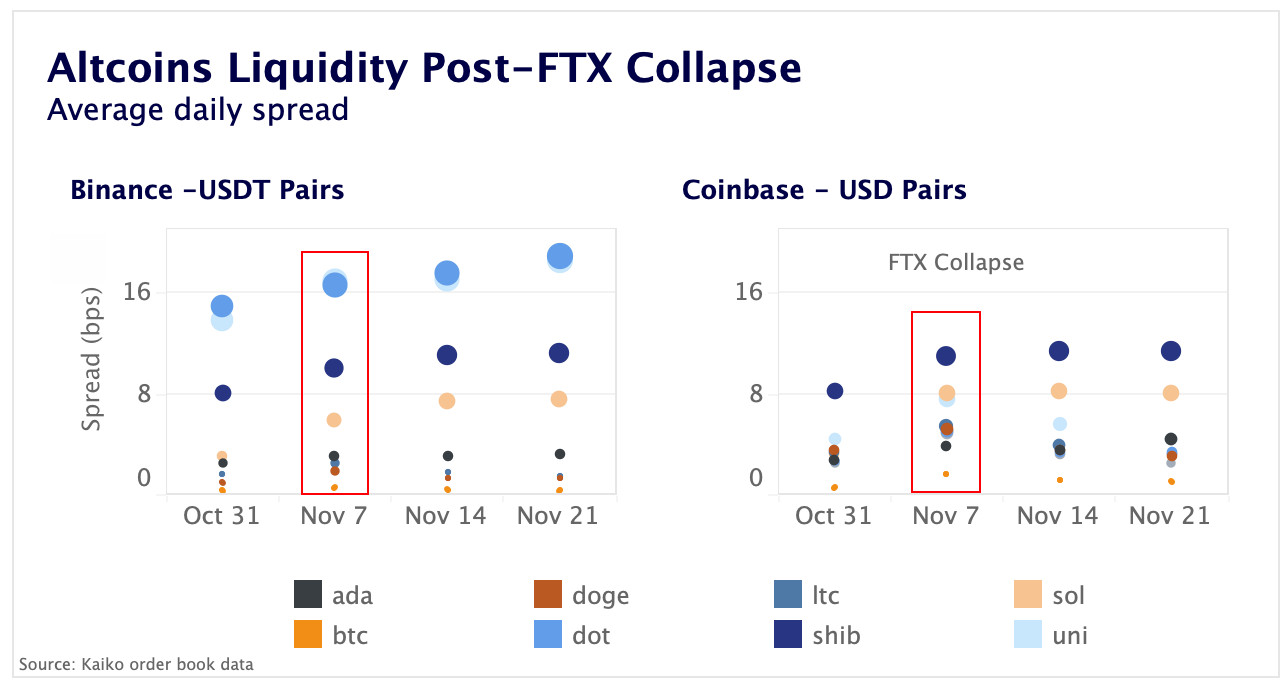

Altcoin liquidity deteriorates post-FTX

The liquidity gap between BTC and altcoin markets has deepened after the collapse of FTX and Alameda. The trend suggests that market makers are providing liquidity asymmetrically, with spreads widening a lot more for higher-beta altcoins. We compare the average daily spreads for the top altcoins by market cap on Binance and Coinbase in the weeks before and after FTX filed for bankruptcy.

Spreads widened the most for Solana’s SOL token, tripling from 2.1bps to 7.4bps on Binance. BTC suffered a more modest impact, with spreads increasing from .25 to .36bps on Binance, while they more than doubled on Coinbase from .55 to 1.15bps.

Overall, liquidity is more evenly distributed between assets on Coinbase's USD markets compared with Binance's USDT markets. Spreads for some low cap altcoins are also significantly wider on Binance. For example, spreads on Uniswaps’s UNI and Polkadot’s DOT tokens are over three times higher on Binance relative to Coinbase.

Alameda was one of the most important market makers for some small-cap altcoins, while other major market makers registered losses and are likely to review their risk controls, which could impact liquidity in the short term.

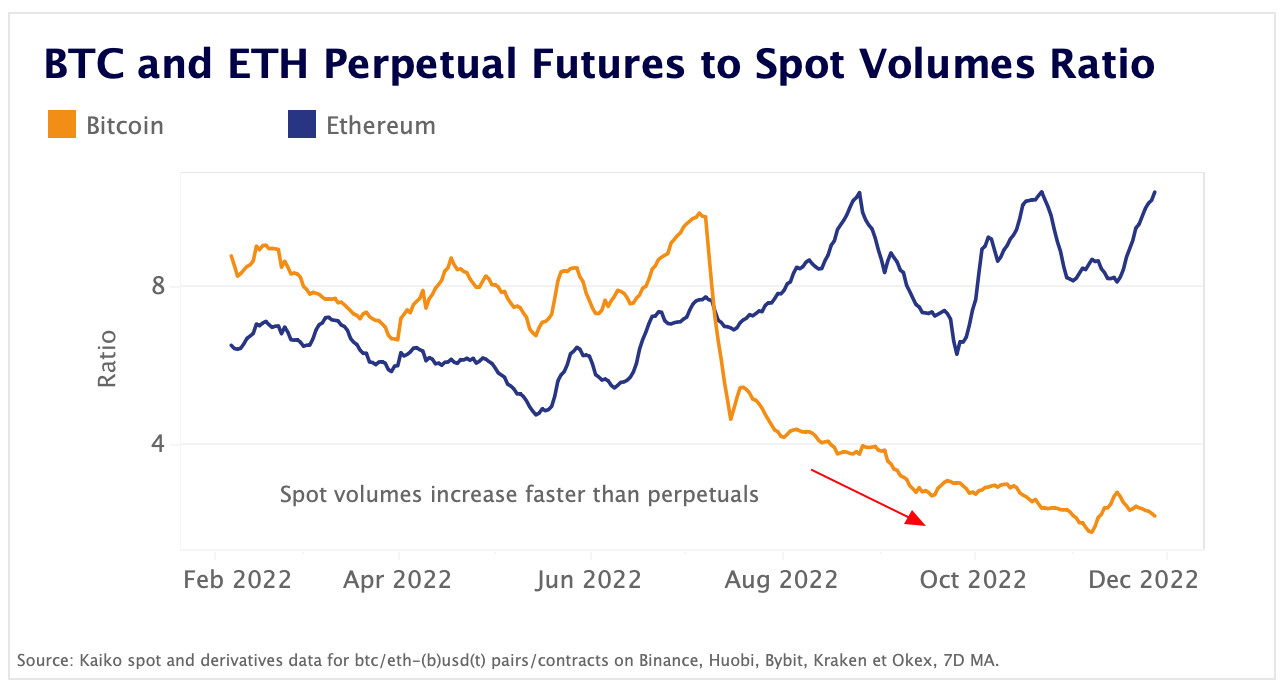

Futures to spot volume ratio hits multi-month low

Bitcoin perpetual futures accounted for just 2x the volume of spot markets in November, a staggering five-fold drop since July 2022. The ratio, which is aggregated on 5 derivatives exchanges (excluding FTX), increases when perpetual futures trading volume outpace spot volumes and vice-versa.

The strong decline is mainly due to the continued growth in Binance’s BTC spot markets after the exchange removed trading fees for 13 BTC pairs in July. Excluding Binance, the ratio exhibited strong volatility, declining moderately from 15 to 13 over the same period. Interestingly, we observe the opposite trend on ETH markets, where an increased amount of perpetual futures trades are being made relative to spot. ETH perps are now at 10x the spot volumes, up from 5x a year ago.

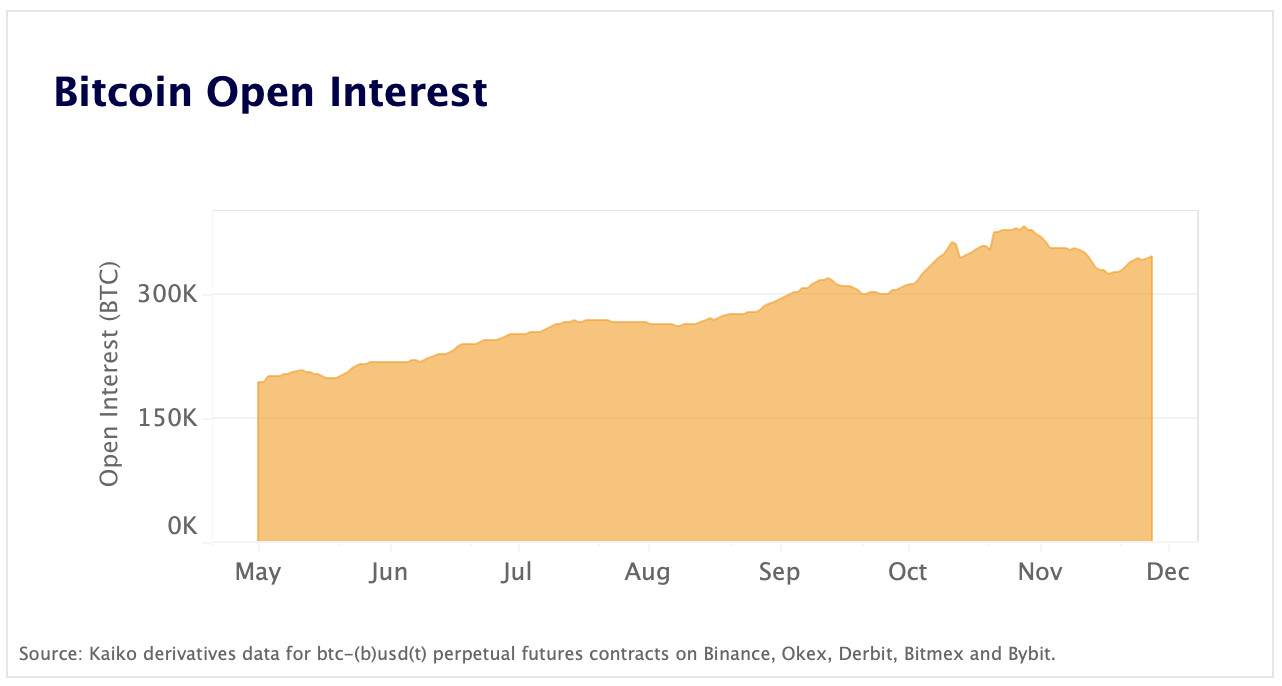

Falling BTC perpetual futures volumes comes amid consistently high levels of open interest. Despite a wave of long liquidations following the FTX collapse, the quantity of open BTC contracts has held steady near all time highs.

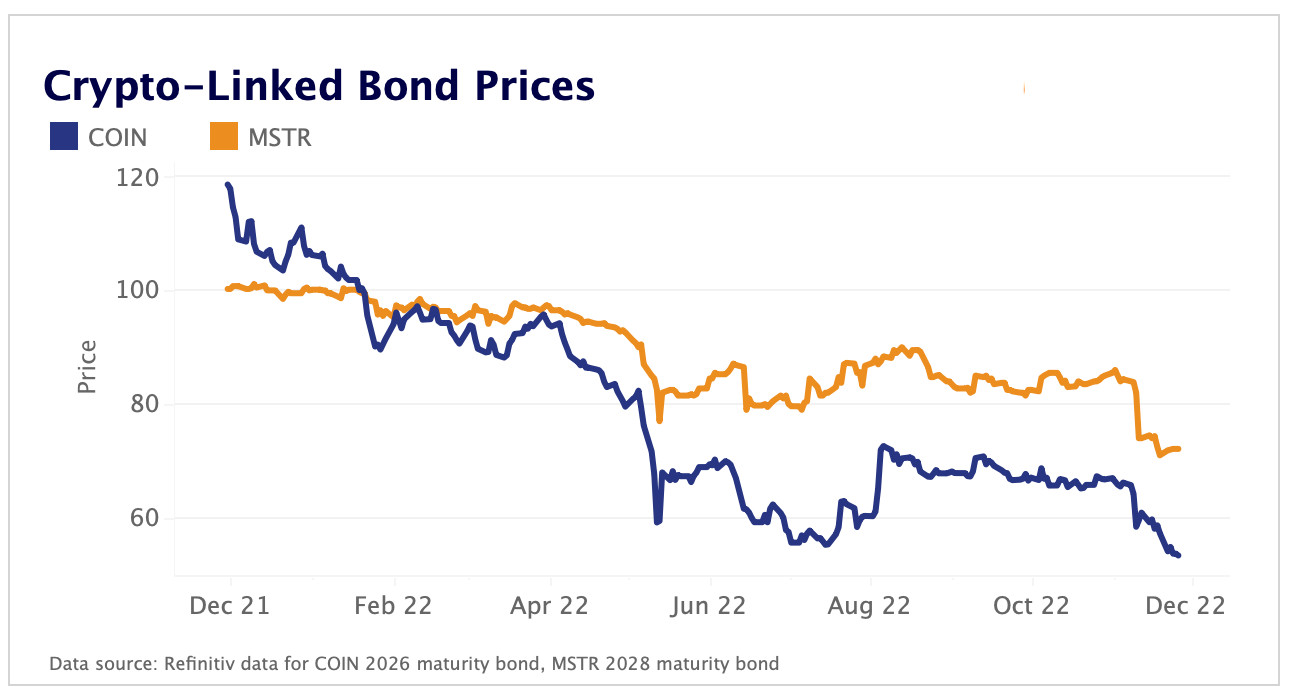

Crypto-linked bonds suffer amid share price collapse

The bonds issued by two of crypto’s largest public names, Coinbase and Microstrategy have suffered along with the rest of crypto. The price of Coinbase’s bond maturing in 2026 dipped to an all time low of 53 cents to the dollar, a level typically associated with distressed debt, while MicroStategy bonds also slumped to a low of 72 cents on the dollar.

In May, Coinbase noted that clients could be treated as general unsecured creditors if the company went bankrupt, impacting the bond’s price even further as bond investors were spooked at the mention of bankruptcy. Yields on the bonds, which move in the opposite direction of price, increased to a high of 19% for Coinbase and 13% for Microstrategy, indicating a general bearishness from the traditional financial system regarding crypto and their companies.