A summarizing review of what has been happening at the crypto markets of the past week. A look at trending sectors, liquidity, volatility, spreads and more. The weekly report in cooperation with market data provider Kaiko.

Markets are soaring after a judge ruled in (partial) favor of Ripple's case with the SEC. Meanwhile, Celsius' CEO was arrested for fraud, Binance laid off 1,000 workers, and Multichain is shutting down. This week, we explore:

- The rivalry between liquid staking protocols.

- The summer liquidity doldrums.

- Binance's biggest offshore competitors.

XRP soars following landmark win for crypto industry

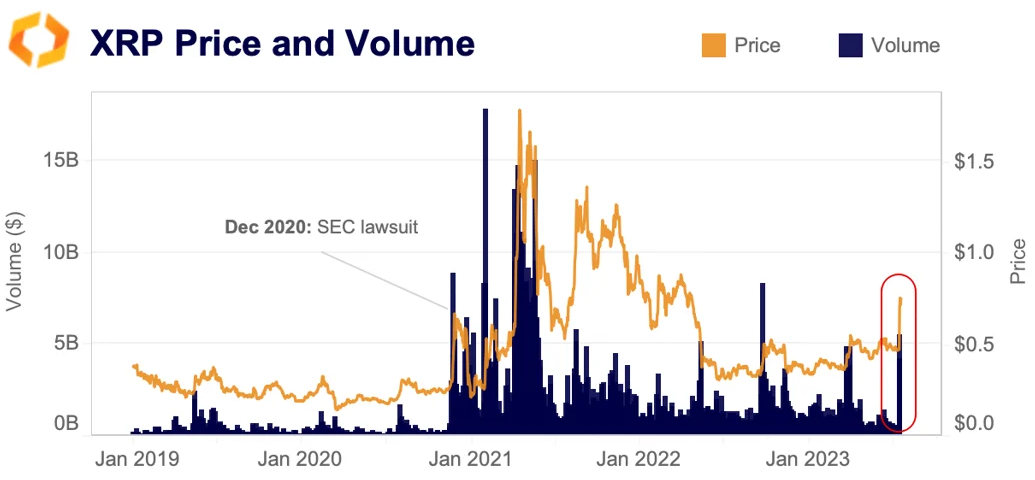

After years of waiting, Ripple finally got a ruling in their highly anticipated lawsuit with the SEC: the company did not violate federal securities law by selling its XRP token on public exchanges. The market reaction was near instantaneous. Since Thursday, XRP is up 61% and several exchanges that had previously de-listed the token, including Coinbase and Kraken, immediately re-listed it.

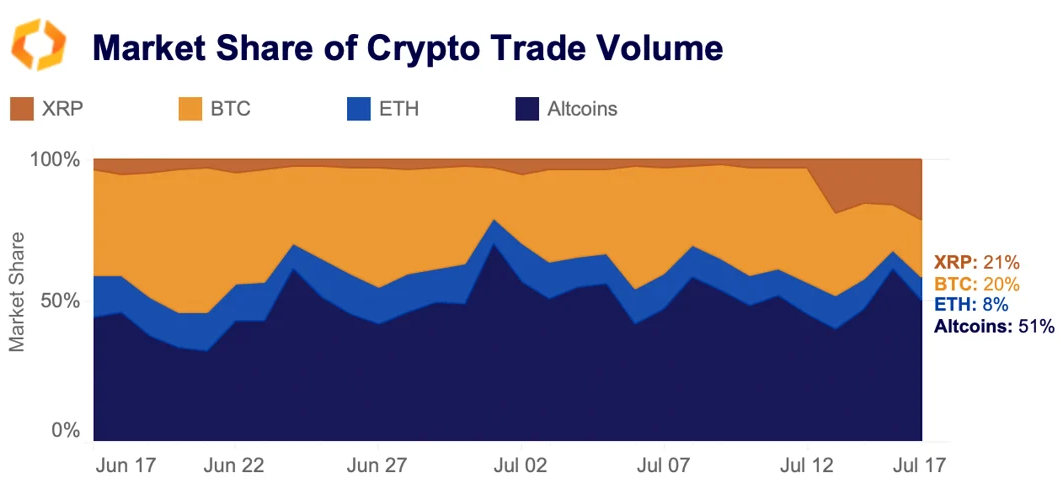

As of Monday morning, XRP accounted for 21% of global crypto trade volume, surpassing BTC and ETH. Altcoin volumes (excluding XRP) did not see as large a bump as expected, despite the bullish implications of the ruling.

What's interesting about XRP is that the lawsuit and exchange de-listings did not have an overly negative impact on price or volume at the time. After XRP was de-listed from most U.S. platforms in 2021, the token maintained a strong offshore following. Korean exchanges in particular have seen huge volumes for XRP, with Upbit and Bithumb collectively processing $476bn in trades since the lawsuit. Today, XRP is trading at 15-month highs, although volumes are at just 10-month highs, which suggests that despite this massively bullish catalyst, global trading activity remains subdued.

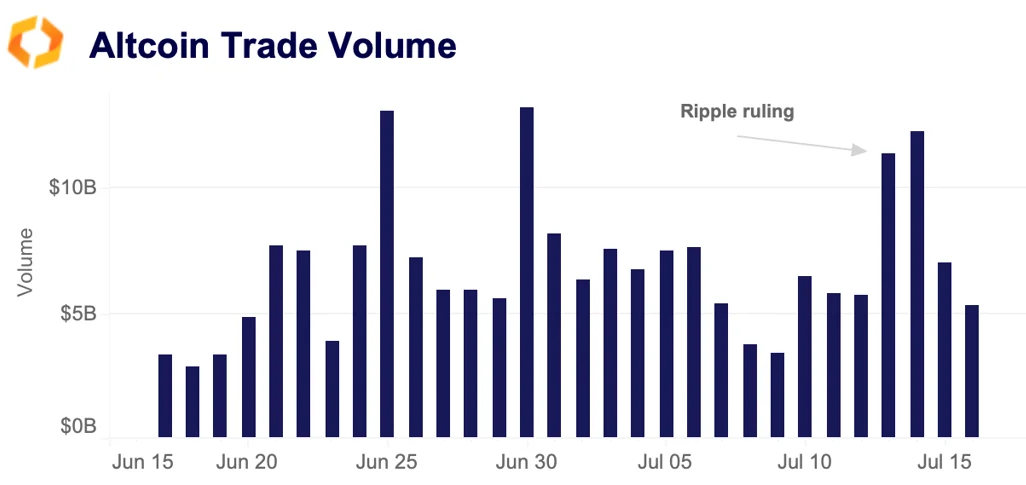

Although this ruling was specific to XRP and does not set binding precedent, the case could be used in future lawsuits, and as such is interpreted as a bullish catalyst for altcoin markets. However, the SEC may decide to appeal the ruling.

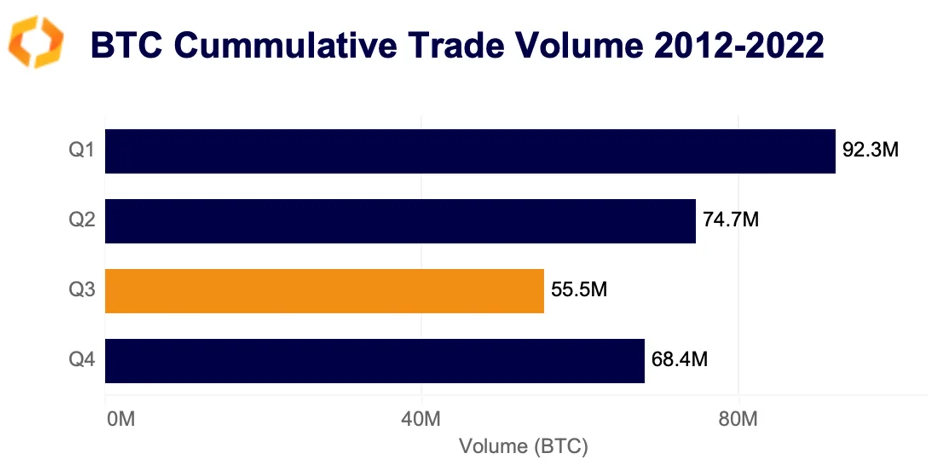

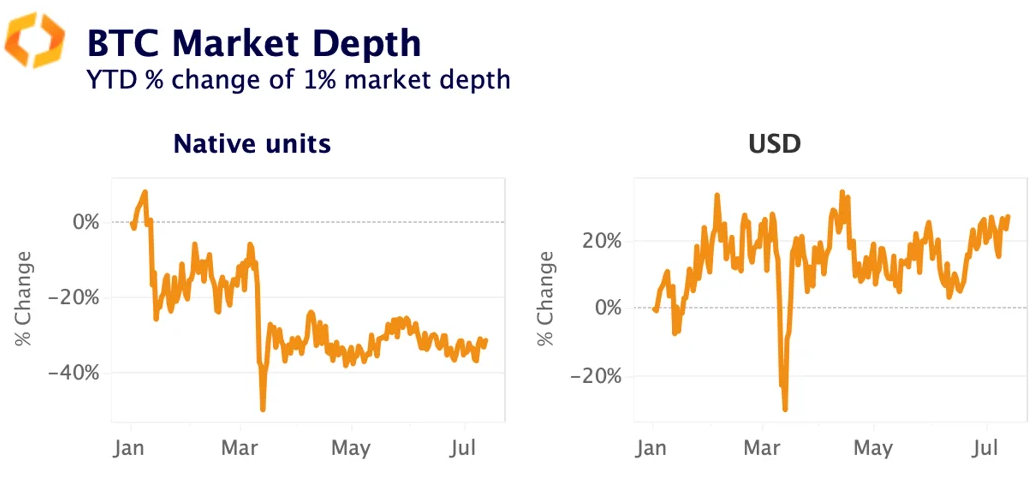

Bitcoin enters summer liquidity doldrums

Q3 has historically been the lowest-volume quarter by a decent margin, suggesting that both crypto and traditional financial markets are entering the typical summer trading lull. Cumulative BTC trade volume in Q3 is a full 13 million (BTC) below the next lowest quarter. While the long awaited XRP ruling has the potential to boost lackluster trade volumes, its full impact will likely take some time to unfold. Order book liquidity — as measured by 1% market depth — could also be an area of concern during the summer doldrums, putting pressure on prices.

Despite the recent June rally, BTC 1% market depth as measured in native units remains 30% lower relative to January's levels. Market depth as measured in dollars is up just 20%, despite BTC rallying far more. The drop in market depth has been stronger on US-based exchanges, where liquidity is down by 40% following an exodus on Binance.US, compared with a 25% drop in off-shore markets.

Weekend trading is resilient despite bank collapses

Weekend trade volume on U.S. exchanges has remained resilient despite the collapse of two major crypto friendly banks — Silvergate and Signature — earlier this year. The share of weekend trade volume in 2023 has actually increased since 2022, accounting for a little less than 20% of total weekly volumes, compared with 18% the previous year.

This suggests traders have managed to operate as usual by either paying a higher price for transfers or switching to larger exchanges such as Coinbase, which managed to resume 24h/7 payment services almost immediately after the collapse of the real time crypto payment networks SEN and Signet.

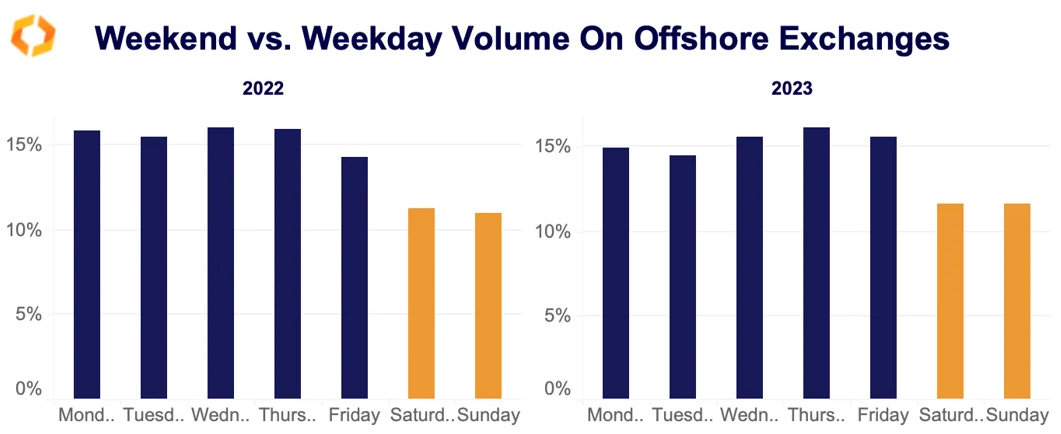

Interestingly, the gap between weekend and weekday trading is much smaller on offshore exchanges, suggesting these markets are more retail-driven. The share of weekend trading is firmly above 20%, with virtually no change year-on-year. Many predicted the collapse of SEN and Signet would have had hugely detrimental effects to weekend trading activity, but so far we are not seeing this in the data.

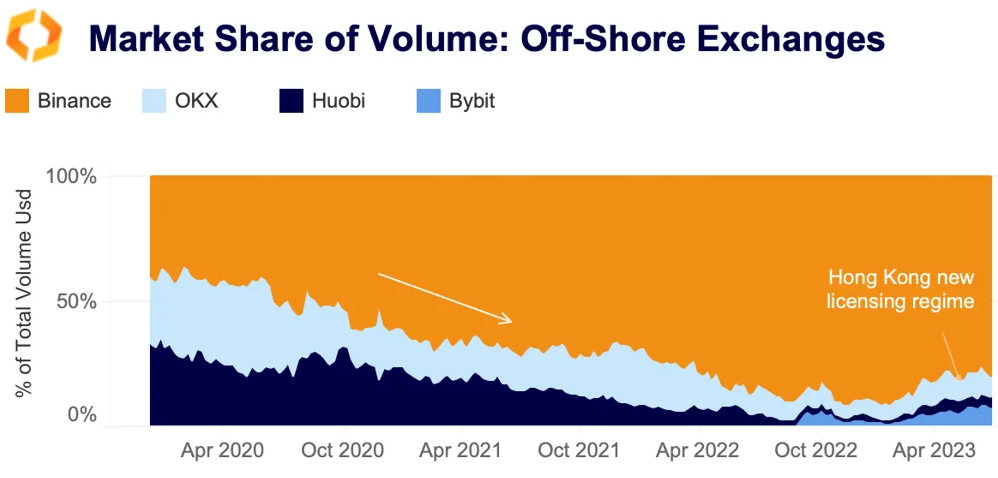

Binance faces competition among offshore exchanges

Over the past few months, offshore markets have become less concentrated, with smaller exchanges gaining momentum as Binance's global dominance suffers steep setbacks. Bybit, which launched its spot trading platform in 2022, saw the strongest increase in market share this year growing from 1% to 8%. OKX market share also jumped to 13% in June, before retreating to 9% in July. Although Huobi's market share remains well below the highs of 2020/2021, it has rebounded to 5% after hitting an all-time low at the end of 2022.

The ongoing Hong Kong reopening will further intensify competition between exchanges. All three exchanges launched dedicated Hong-Kong platforms over the past few months and have seen strong local interest. This suggests some pent-up demand even though a rising number of economists fear a period of sluggish growth in China due to a lack of borrowers (known as a balance sheet recession).

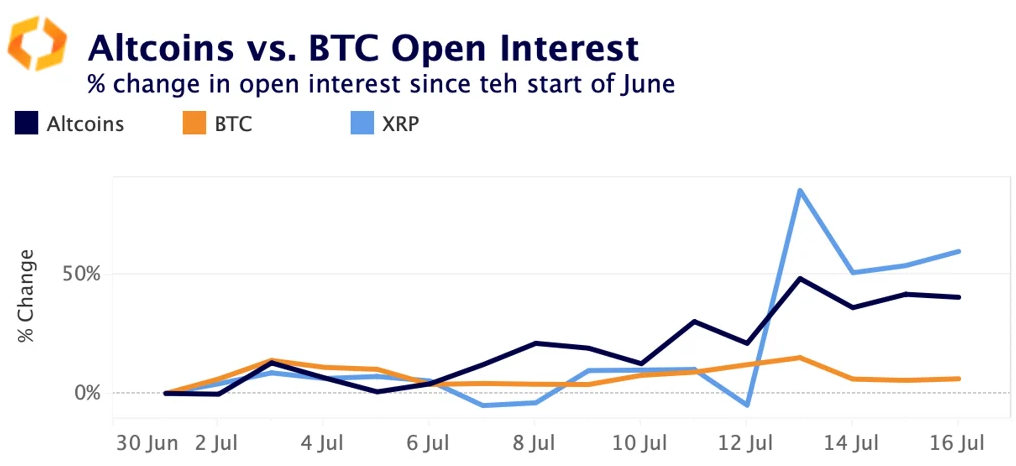

Altcoins see uneven inflows post XRP-ruling

Inflows into altcoin derivatives markets have accelerated in July, boosted by the XRP ruling last week. XRP open interest aggregated on Bybit, Binance, Deribit and OKX surged to $365mn - its highest level since Nov 2021 on July 13 before retreating slightly.

The combined open interest for eight altcoins categorized as securities in both the Binance and Coinbase lawsuits (ADA, SOL, MATIC, FIL, SAND, MANA, ALGO, and AXS) is up 40% since the start of the month to around $776mn. However, while inflows into Solana’s SOL, Caradano’s ADA, and Polygon’s MATIC accelerated, other altcoins saw outflows. AXS, MANA, ALGO and SAND open interest is down between 13% and 24% in July suggesting demand for leverage diverged significantly between altcoins.

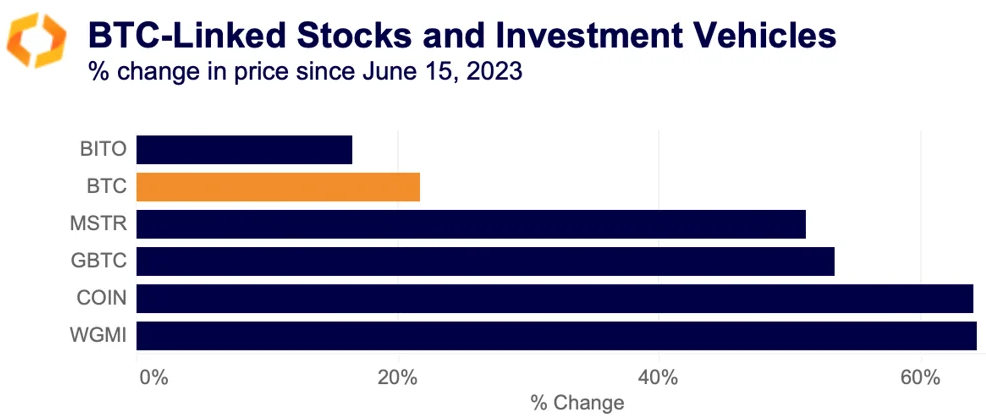

COIN outperforms BTC-associated investments

BlackRock's spot BTC ETF filling has had diverging second-order effects on Bitcoin-linked stocks and investment vehicles as investors are factoring in its potential market impact. ProShares BITO futures-backed ETF underperformed BTC spot prices since June 15, while BTC miners and Coinbase outperformed by a large margin.

In the long run, a spot ETF could be a significant competition to CEXs. However, Coinbase will likely benefit from its role as BlackRock custodial partner in addition to the rising demand for BTC. Currently, around 2.3% of Coinbase's net revenue comes from custodial fees but this share is expected to increase, helping to diversify its revenue stream. Valkyrie Bitcoin Mining ETF (WGMI) has also experienced a significant surge of 64%. Miners stand to benefit from higher BTC spot prices even though a spot ETF could potentially reduce demand for their shares.

Both MicroStrategy and Grayscale Bitcoin Trust (GBTC) are up by over 50% since mid-June. Sentiment around GBTC’s conversion to ETF has improved significantly over the past month, leading to the narrowing of the so-called Grayscale discount. MicroStrategy which holds over 150K BTC is the largest corporate holder of Bitcoin, offering leverage exposure to the asset. Investors expect the company to benefit from the upcoming BTC halving next year.

U.S. Inflation slows more than expected

U.S. inflation showed signs of cooling last week, with both the headline and core (less food and energy) CPI numbers undershooting expectations. The core CPI which is less impacted by business cycles, rose by 3% year-over-year and 0.2% month-over-month vs. 3.1% and 0.3% expected. This is unlikely to deter the Fed from hiking by 25bps next week as inflation continues to run above its 2% target. However, markets are now widely expecting the upcoming rate increase to be the last in the current cycle. While this is a good news for risk assets, BTC prices barely moved following the release indicating that macro events are having less influence on its prices this year.