JPMorgan is the first major U.S. bank to offer all of its wealth management clients access to crypto funds. The bank gave the green light to its financial advisors to begin offering a number of crypto financial products. U.S. financial services firm JPMorgan has given its financial advisors the green light to offer five cryptocurrency products effective immediately, according to Business Insider. The new option is now open to all clients seeking investment advice. This includes self-managing clients in the commission-free Chase trading app, the mass of affluent clients who have their assets managed by JPMorgan Advisors, and the institutional…

Author: Editorial Office CVJ.CH

BNY Mellon has joined a consortium of banks that are collaborating to develop a platform to support the entire lifecycle of digital assets. The collaboration includes other big-name U.S. banks that are gradually entering the industry. The collaboration follows an announcement by BNY Mellon in February 2021 that it would build a new digital assets unit. This includes multi-asset custody for traditional and digital assets. Now, the oldest bank in the United States is expanding further in the space, while other established financial services providers are also taking action. Consortium of major U.S. banks BNY Mellon is now making its…

Mastercard has announced that it will expand its card program to include crypto wallets and exchanges, in a collaboration with Circle. This is expected to make it easier for customers to convert cryptocurrency to traditional fiat currency, and spend it via a regular credit card. Five months after Mastercard announced it would bring select stablecoins to its network, the credit card giant is getting active again. The latest collaboration with USDC issuer Circle is a crucial step to expand the ecosystem. In doing so, Mastercard aims to set the stage for the future of crypto payments in a secure and…

A Federal Reserve research paper proposes regulation for the stablecoin ecosystem and calls for ways to address systemic risks. Their issuers should be regulated as banks and central banks should launch their own digital currencies (CBDCs). A member of the Board of Governors of the Federal Reserve System as well as a Yale University professor propose oversight of the stablecoin ecosystem in a recently published paper, “Taming Wildcat Stablecoins”. They call for addressing systemic risks, regulating stablecoin issuers as banks, and introducing central bank digital currencies (CBDCs). Furthermore, they conclude that privately issued stablecoins are not an effective medium of…

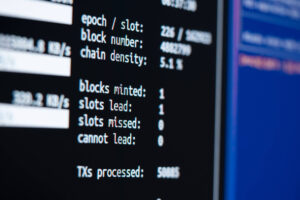

A summarizing review of what has been happening at the crypto markets of the past week. A look at trending sectors, liquidity, volatility, spreads and more. The weekly report in cooperation with market data provider Kaiko. The last 7 days in cryptocurrency markets: Price Movements: Crypto markets continued to take a beating this week as regulators turn an eye to cryptocurrency exchanges. Volume Dynamics: Bitfinex’s market share surged over the weekend due to higher-than-average Bitcoin volume. Order Book Liquidity: Liquidity has plummeted on Binance’s British Pound markets following the UK’s regulatory ban. Macro Trends: U.S. measures for inflation registered their…

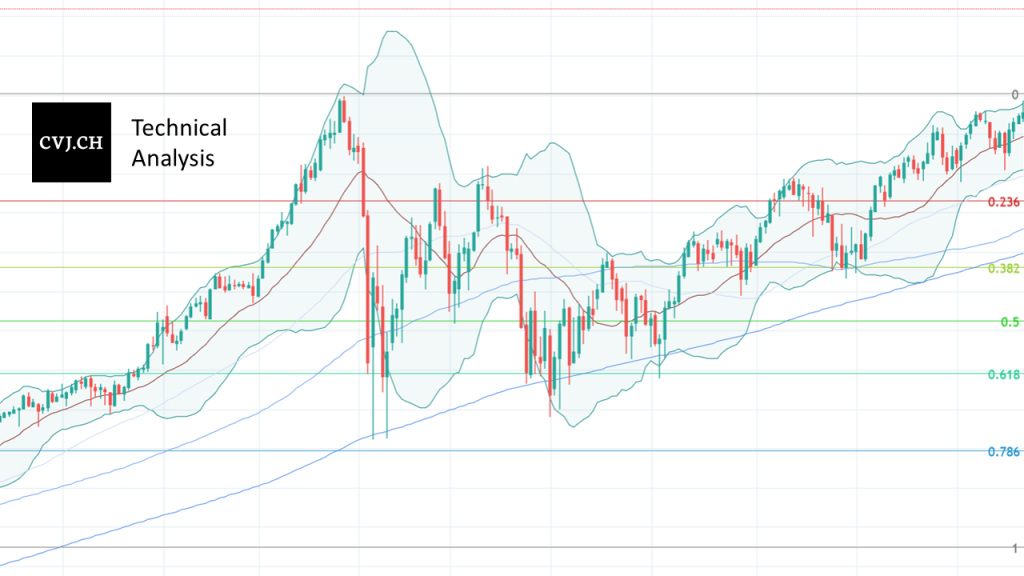

Bitcoin USD daily basis Bitcoin USD Chart Analysis – Continuously Lower Prices The reporting week started with continued trading activity at the previous week’s level in the 33’500 USD area. While the Bitcoin price exited the market on Sunday still slightly higher than the previous day at 34’258 USD, there was selling pressure on Monday. This led the price at the end of the day back to 33’000 USD, a zone that has often played a role since the consolidation. On Tuesday and Wednesday, the price consolidated in narrow trading ranges in the area of 33’730 USD. However, towards the…

InCore Bank’s new crypto asset solution, established with securitization platform provider GenTwo Digital, allows asset managers and banksfor the first time to easily tailor innovative investment products in crypto currencies under their own name. InCore Bank, the Swiss B2B banking service provider, announced the launch of the first comprehensive crypto asset solution. The securitization solution named CRYSPwas established in cooperation with GenTwo Digital, the leading provider of modern securitization platforms for digital assets. The solution allows all asset managers, whether they are from a bank or external, to build bankable products based on crypto currencies, and then offer them to…

Digital asset and art specialists Sygnum and Artemundi have jointly tokenized the painting “Fillette au béret” by Picasso. For the first time, ownership of a work of art has been transferred from a regulated bank to the blockchain through tokenization. The Swiss digital asset bank and art investment pioneer have teamed up to fragment the ownership rights to Picasso’s painting “Fillette au béret” into so-called Art Security Tokens (ASTs). According to Sygnum, tokenisation has the potential to create transparency and democratise the US$60 billion annual art market. With the issuance of 4,000 tokens by the regulated Sygnum Bank, investors will…

The Swiss Digital Asset and Wealth Management Report forms a new reference publication for the financial industry in Switzerland. Based on 100 interviews, it provides a picture of the Swiss “Digital Asset” ecosystem with its various sub-categories. Digital assets and “tokenization” are on the rise. Especially in recent months, record-breaking funding rounds, innovative product launches and a growing interest in new financial products have dominated global news cycles. To better grasp the Swiss ecosystem around digital assets, investment specialist CV VC, in collaboration with the Swiss Blockchain Federation and Alexander Brunner, is publishing the “Swiss Digital Asset & Wealth Management…

The Governing Council has decided to launch a trial phase of a digital euro project (CBDC), which is expected to last 24 months. The decision was made after the preliminary experimentation phase did not reveal any technical obstacles. In a press release, the ECB announced concrete steps towards the introduction of a digital euro. Exploratory phase of CBDC digital euro project to last 24 months Design to be based on user preferences and technical advice from retailers and intermediaries So far, no technical obstacles have been identified during the preliminary trial phase “It has been nine months since we published…

An exclusive partnership of crypto exchange traded products (ETPs) issuer 21Shares AG and Germany’s largest online financial platform Comdirect, allows investors to add crypto products to their savings plan. In this innovative partnership, 21Shares has been appointed as the exclusive provider of physically backed crypto ETPs for the online broker’s savings plan program. Eleven of 21Shares’ ETP offerings currently listed in Germany are available on the Comdirect platform. Bridge between crypto investments and savings plans Currently, Comdirect offers products and services to more than 2.9 million customers (September 2020) so they can easily and conveniently conduct their banking and securities…

A summarizing review of what has been happening at the crypto markets of the past week. A look at trending sectors, liquidity, volatility, spreads and more. The weekly report in cooperation with market data provider Kaiko. The last 7 days in cryptocurrency markets: Price Movements: Following the UK’s Binance ban, Bitcoin pairs denominated in the British Pound have traded at a steep discount to the U.S. Dollar. Volume Dynamics: Average weekend trading volume has increased relative to weekday volumes over the past year. Order Book Liquidity: The bid-ask spread for BTC-USD pairs has widened on all exchanges analyzed throughout this…

Bitcoin USD daily basis Bitcoin USD Chart Analysis – Stalemate accompanied by declining volatility Incipient selling at the beginning of the reporting week led the Bitcoin price back below the 34’000 USD mark on Monday. This was followed by two trading sessions in narrow trading ranges around this very price area on Tuesday and Wednesday. On Thursday, persistent sell orders brought the price back to the 32’000 USD mark at the daily low. This negated the establishing positive microstructure from higher daily lows last week. However, negative momentum then failed to materialize on Friday, and the market recovered to 33’851…

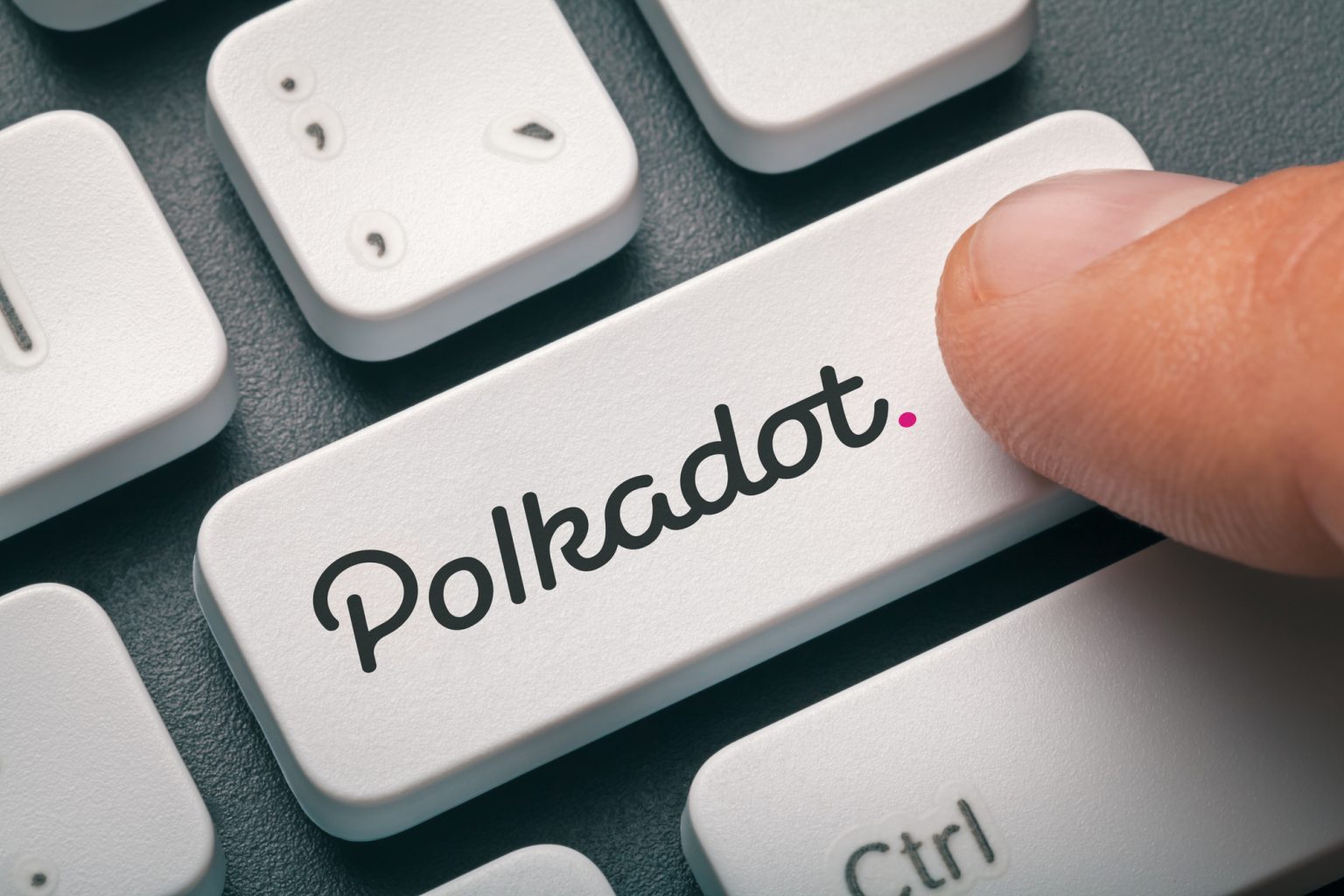

SEBA Bank will list a new Polkadot tracker certificate on the SIX exchange from July 9, 2021. In addition, the bank will include Polkadot in the SEBAX Crypto Asset Select Index with an initial weighting of 7.8%. SEBA Bank believes that Polkadot is one of the most exciting projects in the digital asset space, due to its ambition of connecting all blockchains with one another and thus enabling cross-chain transfers of any data and asset, not just tokens. Through this it is achieving true interoperability. Foundation for Web 3.0 This is especially important in the creation of a fully decentralized…

Circle’s IPO brings all USDC Central Consortium members to the public market. The second-largest U.S. dollar stablecoin, which is jointly managed with crypto exchange Coinbase, has gained strong popularity and is gradually becoming a competitor for Tether (USDT). Circle, the issuer of the USDC stablecoin, will go public in a merger with special purpose entity Concord Acquisition Corp – a publicly traded special purpose acquisition corporation (SPAC). The deal is valued by Circle itself at $4.5 billion. It is expected to close in Q4 2021. Circle IPO aims to create transparency The merger comes just weeks after the company received…

Swiss banking giant UBS has warned its clients about the risks that more intense regulatory requirements pose to the crypto market. A tougher regulatory crackdown could lead to a bursting of the “crypto bubble,” according to the big bank. In a letter to its clients, UBS explained why it considers digital assets too risky and unsuitable to offer to professional investors. Regulators around the world are eager to crack down on crypto markets, it said. After a tougher crackdown, the “crypto bubble” could burst, according to UBS. Regulatory crackdown on cryptocurrencies An obvious example of a change of mind among…