A summarizing review of what has been happening at the crypto markets. A look at trending sectors, liquidity, volatility, spreads and more. The weekly report in cooperation with market data provider Kaiko.

Bitcoin (BTC) saw strong volatility over the week following the landmark approval of several spot ETFs in the U.S. Despite hopes that the rally would continue, BTC closed the week in the red dipping to $42.6k from a high of $48.7k. Ethereum (ETH) ended up being the surprise winner, closing Sunday up 11% as traders anticipate a spot ETH ETF could be next in line. In other industry news, USDC issuer Circle filed for an IPO and Genesis Trading paid $8mn to settle a New York lawsuit. This week we explore:

- The post-ETF market downturn

- USDC's rising market share

- BRC-20 trading trends

Bitcoin slumps post-ETF approval

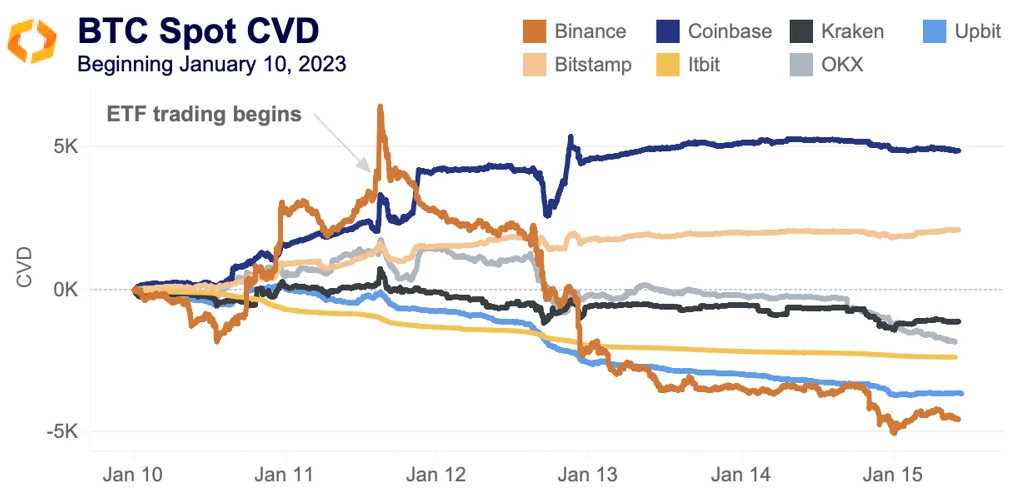

Last week, the long-awaited spot bitcoin ETFs became a reality. The ETFs began trading last Thursday, with a strong surge in cumulative volume delta (CVD) across all major exchanges; a net of nearly 3k BTC was market bought on Binance in the hour surrounding market open in the U.S. However, as some had feared, "sell the news" took hold and Binance's CVD quickly fell into the negative, as did OKX's.

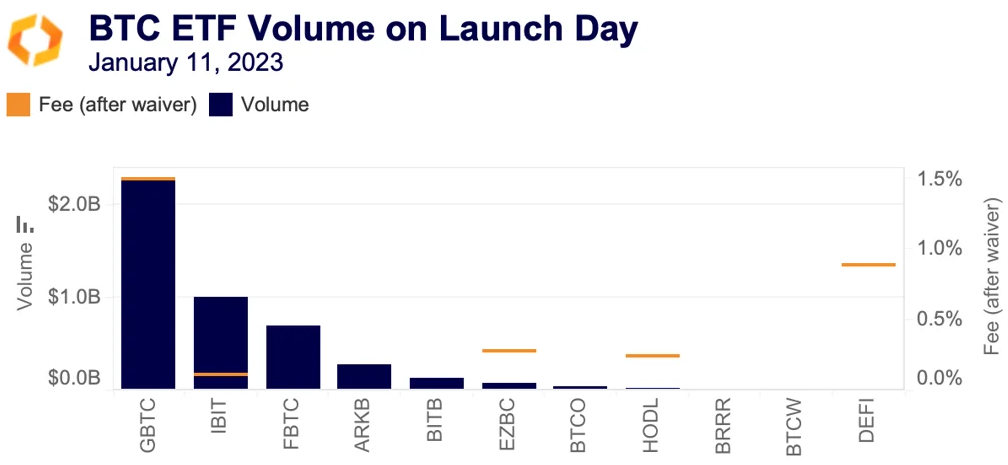

Meanwhile, Coinbase's CVD has remained positive despite the price slump and Bitstamp, a more institutional exchange, has also been firmly positive. Itbit, another institutional exchange, though with lower volumes, showed consistent selling, along with Upbit, showing consistent selling with few retraces. All in all, this suggests that there was no singular, dominant strategy at play around the ETF launch. Regarding the ETFs themselves, GBTC dominated volumes, followed by BlackRock's IBIT and Fidelity's FBTC.

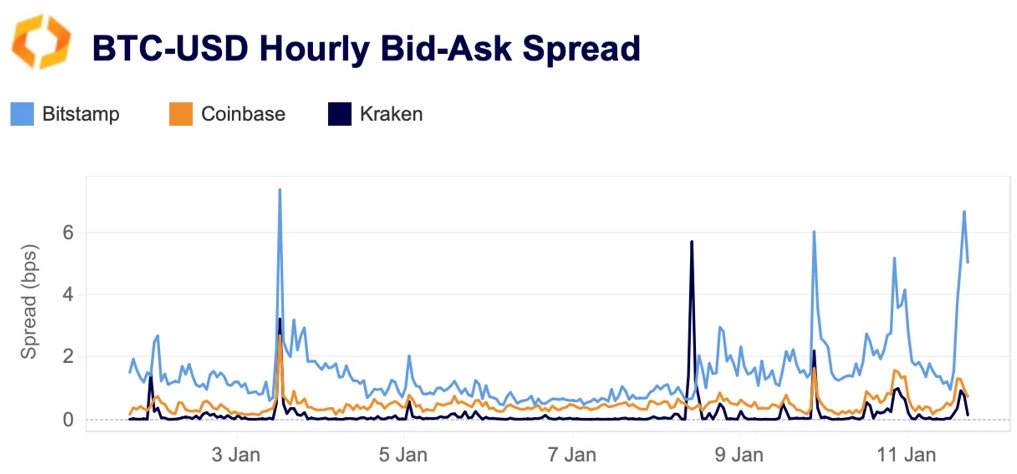

All eyes are on ETF inflows and outflows to determine how much GBTC will be sold given that some investors have held it for years, weathering significant discounts to its underlying holdings; the discount has now fallen to near-zero. Spreads on top BTC-USD instruments have been volatile since launch day as a result of increased volume and continued low liquidity relative to pre-FTX collapse standards.

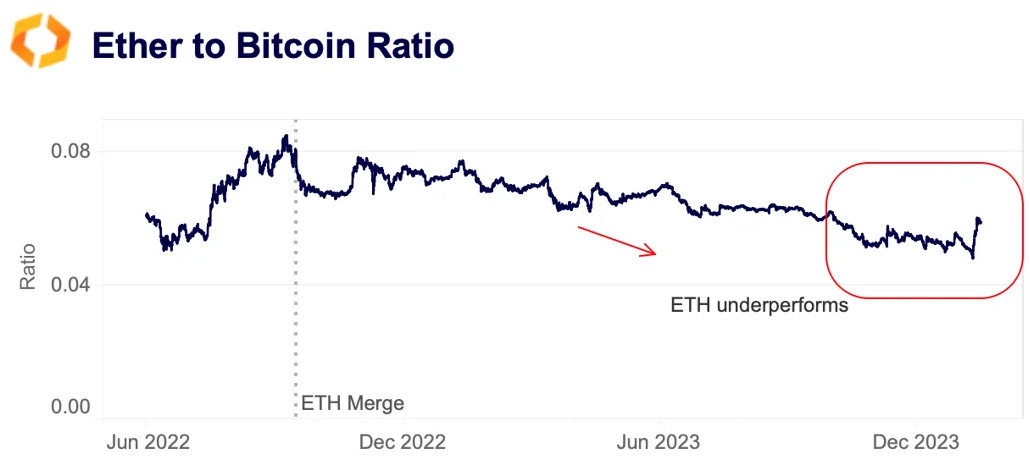

We will continue to closely monitor spot liquidity as exchanges face new competition for BTC volume. Elsewhere, ETH and ETH-related tokens were the prime short-term beneficiaries of the ETFs' approval, as speculation quickly shifted to a coming decision on spot ETH ETFs. After dropping to yearly lows, the ETH to BTC ratio reversed sharply over the weekend.

The BTC ETFs were approved by the slimmest of margins — 3 to 2 — with Grayscale's successful lawsuit against the SEC playing a crucial role in the decision. Given ETH's murkier regulatory status, ETH ETFs appear to face a slightly more challenging path to approval.

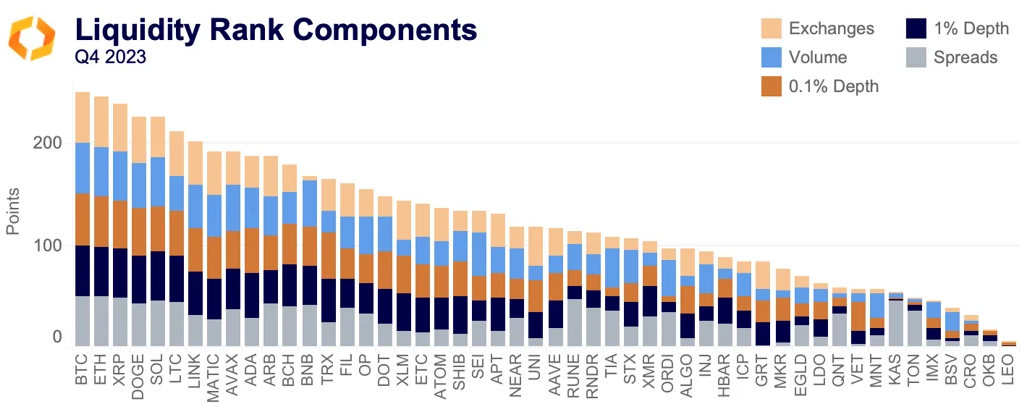

Unveiling our Q4 crypto asset liquidity ranking

Following a dreary Q3, Q4 was a relative explosion of activity which brought some big changes to our liquidity ranking. We are pleased to have expanded the ranking to the top 50 tokens by market cap. The top four tokens in our ranking – BTC, ETH, XRP, and DOGE – have remained unchanged. The first change comes in the five spot, with SOL jumping ahead of LTC. After that, the ranking becomes more chaotic: LINK is up 6 places to the 7 spot, MATIC 4 places to the 8, and AVAX up a whopping 14 to the 9 spot.

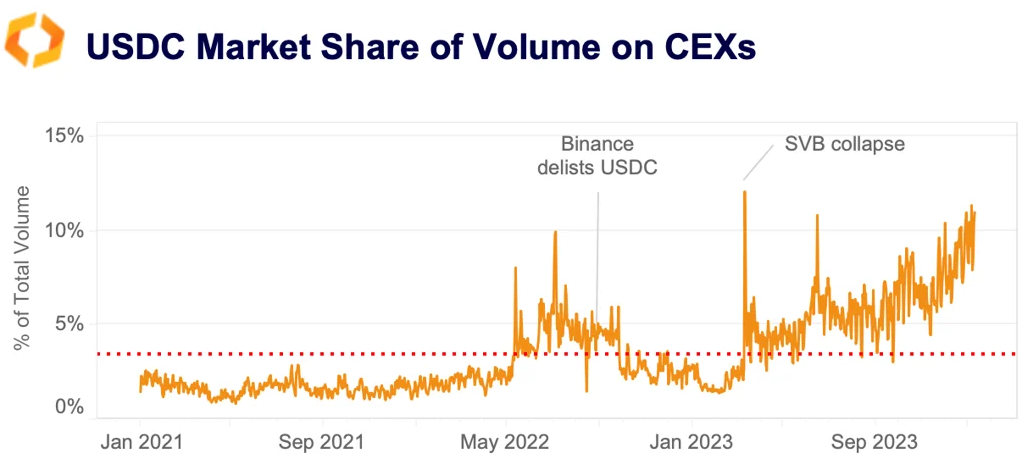

USDC market share on CEXs doubles

Last week, USDC’s issuer, Circle, filed for an initial public offering (IPO) with the SEC after a previous failed attempt. Even though USDC faced headwinds last year after one of its banking partners Silicon Valley Bank collapsed, its market share on CEXs has doubled over the past year, hitting its highest level since 2021 last week.

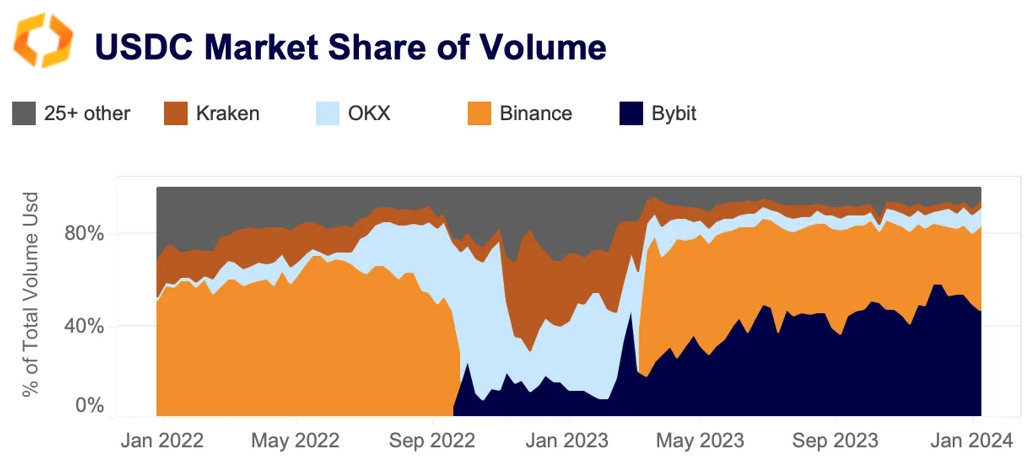

Bybit, which launched zero-fee trading for USDC trading pairs in February, has emerged as the largest USDC market, helping boost the stablecoin's global usage. Binance, which re-listed USDC after the crackdown on BUSD, has failed to recover its dominant market share and is currently the second largest USDC market, with 37% share.

The change in market share comes as the stablecoin wars heat up with new entrants like PayPal USD (PYUSD) and euro-based stablecoins.

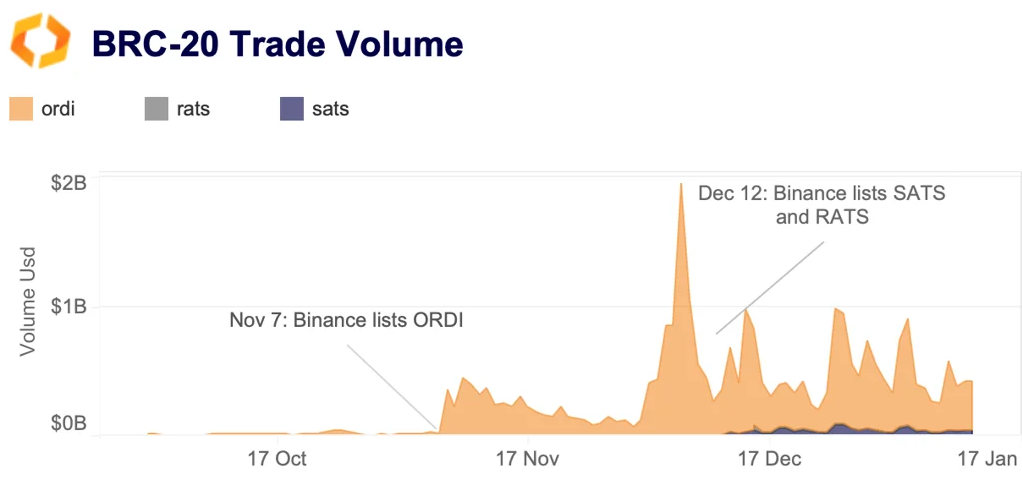

BRC-20 token trade volume surges

BRC-20 is a new type of crypto token standard on the Bitcoin network, created in March 2023. It leverages the Ordinals protocol, which enables data inscriptions on satoshis, the smallest unit of BTC. Trade volume for this type of token has surged tenfold since November, from just $10-15mn to more than $500mn. The increase came after Binance launched spot and perpetual futures trading for ORDI, SATS and RATS.

Binance’s market share of trade volume initially surged to 63% but has been declining since and currently hovers around 50%. OKX, which was the first exchange to list ORDI back in May, is the second largest spot market for BRC-20 tokens, with a market share of 35%. Rising BRC-20 volumes have boosted demand for block space on the Bitcoin network and pushed transaction costs higher, spurring controversy.

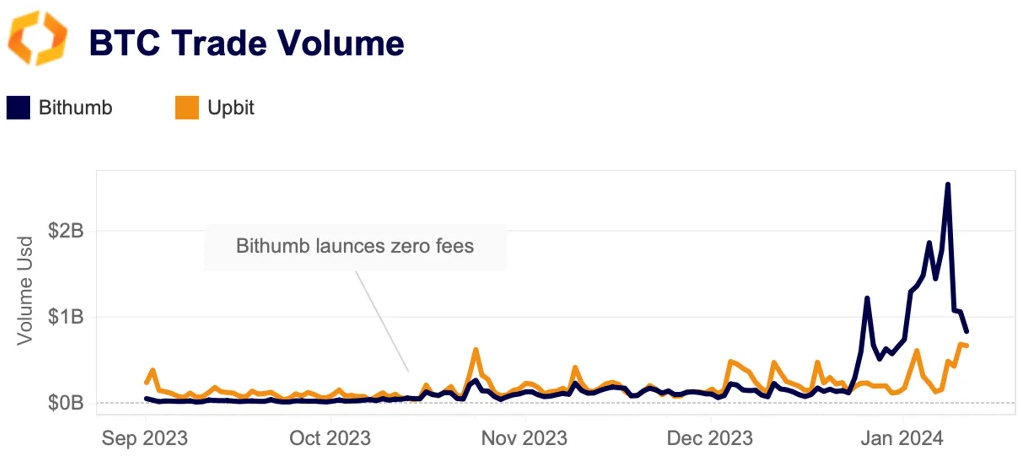

Breaking down an unusual trading trend on Bithumb

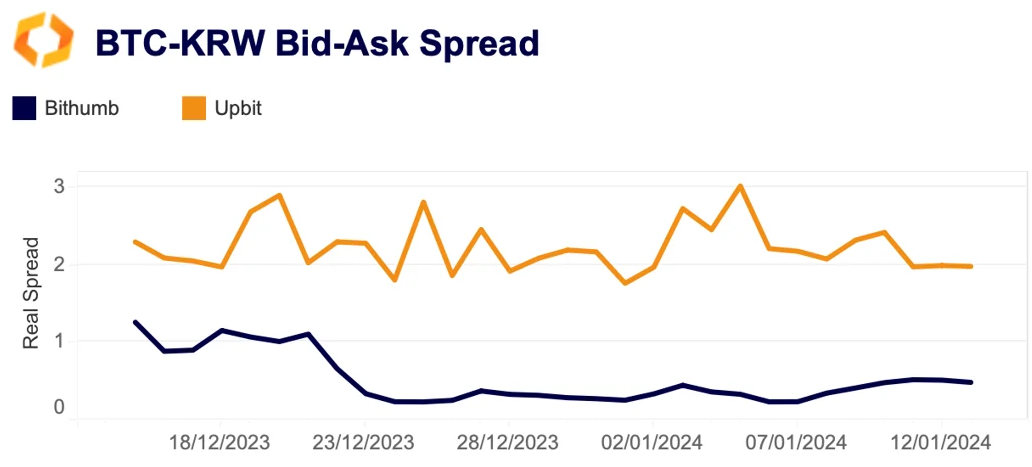

BTC-KRW trade volume on the Korean exchange Bithumb has surged since the end of December, hitting an all-time high on January 8 before retreating last week. This briefly boosted the exchange’s market share among other Korean exchanges to 48%, its highest level since 2021. BTC was the most traded asset on Bithumb in 2023, representing 70% of its volume, compared to just 11% on Upbit. Bithumb launched zero-fee trading in October, but its trade volume was slow to take off. In early December, it expanded its offering by listing USDT.

Historically, Bithumb has had tighter bid-ask spreads for BTC-KRW than Upbit. However, the gap has widened significantly since early December. Spreads on Bithumb have declined from more than 1.4bps to just 0.5bps while they have remained above 2bps on Upbit. Last week, Korea’s financial regulator said brokering U.S. spot BTC ETFs in Korea could be illegal, which could slow Korean BTC demand.